Trick takeaways

In the past, each generation boosted financially: more education and learning, much better work, homeownership, and longer lives.

That higher trajectory is currently concerned, especially for Millennials and Gen Z.

Youthful Australians are increasingly doubtful that they’ll be wealthier or more secure than their parents.

Recognising generational changes allows wise financiers to prepare for changes in housing need, family development, and asset preferences.

Don’t suspend young Australians– they’ll still develop wide range, but on various timelines and terms.

As constantly in home, the earlier you recognize the macro fads, the much better located you are to gain from them.

Will today’s younger generations wind up wealthier, better, and extra protected than their parents?

That utilized to be a no-brainer.

For much of Australia’s contemporary background, each generation climbed the financial ladder greater than the one before it. Much more education, far better jobs, larger homes, longer lives.

However that narrative is currently being examined, particularly by the very individuals implied to live it.

So, are young Australians still on course to be much better off? Or has the promise of generational progress silently escaped?

Allow’s take a better look at what the evidence really claims– and what it suggests for us as property financiers and wealth building contractors.

Let’s begin with some context

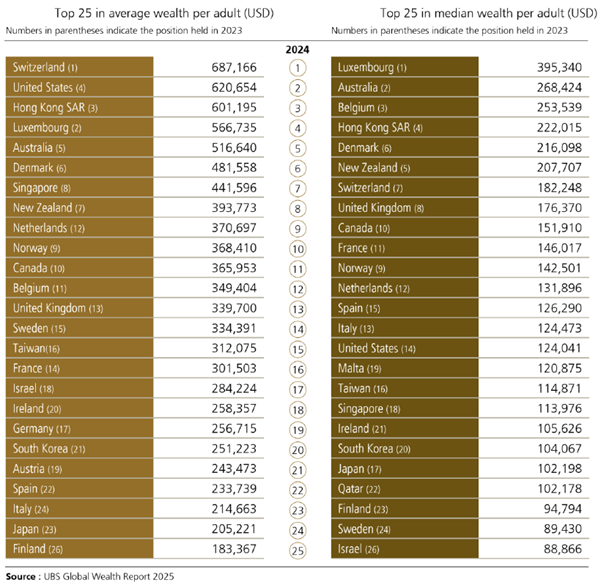

According to the 2025 UBS World Wealth Report, our riches raised by 11 % in 2024, and Australia ranks second globally in terms of typical wealth per adult.

Nonetheless, most of Australia’s wealth is concentrated in the hands of Baby Boomers, and there are a couple of clear reasons why.

To start with, Boomers have actually just had time on their side.

Lots of entered the workforce during an era of strong wage growth, inexpensive residential or commercial property rates, and charitable superannuation reforms.

They had the ability to buy homes in the 1970 s, 80 s and even early 90 s– when typical residence rates were simply a couple of times the typical earnings, not 8 to 10 times like they are today.

As the years rolled on, increasing residential property values and good tax obligation plans turbo charged the riches of owner-occupiers and financiers alike.

Second Of All, Infant Boomers benefited from stability.

They endured a period of financial expansion, reduced education prices, and much more secure full-time work.

Several currently have accumulated substantial equity in their homes, typically being home loan free.

Include in that the surge in share market involvement with superannuation, and for some, inheritances from their very own parents, and it’s easy to see why this generation holds a disproportionate slice of the country’s wide range.

Today, Boomers regulate over half of Australia’s personal wide range, in spite of representing only a quarter of the population.

This isn’t unfair – it mirrors a lifetime of accumulation, but it raises important concerns about intergenerational equity and exactly how that wealth will be transferred in the years ahead.

So back to the original inquiry– will young Australians be far better off than their moms and dads?

E 61 Institute looked at this and came up with some interesting searchings for …

A generation that’s even more informed and more indebted

There’s no question that young Australians are one of the most very educated generation in our country’s history.

They’re greater than two times as likely to hold a college degree as their moms and dads were at the exact same age, and they’re far much less likely to quit of school early.

That’s a win.

Yet education hasn’t come affordable.

More than 30 % of Australians under 35 now lug a student financial debt, up from 20 % a decade earlier, and the typical HELP debt has ballooned to over $ 26, 000

Lots of are still settling that financial debt well into their mid- 30 s, right when they’re attempting to save a deposit or begin a family members.

It’s not just the dimension of the financial debt– it’s the timing.

And it’s holding them back.

Making a lot more … yet taking home less?

Young Aussies are making similar genuine incomes to those who came prior to them.

In fact, early-career profits are generally equivalent to those of Gen X.

However after the Global Financial Dilemma, income development for under- 40 s has dropped significantly behind that of older Australians.

Add to that a change toward insecure, lower-paid job and lowered work mobility, and you obtain a generation having a hard time to construct financial momentum.

And while older Australians delight in tax-free gains on their homes and resources gains price cuts on their investments, more youthful employees bring the expanding worry of income tax obligation, courtesy of brace creep.

And while some Gen Zs will take advantage of the biggest wave of inheritances in Australian background, as I pointed out above, these windfalls usually come far too late, usually in their 50 s.

That doesn’t help much when you’re 30, renting, and trying to increase youngsters.

The homeownership desire is fading

No place is the generational void much more noticeable than in real estate.

Homeownership rates among 25– 34 -year-olds have plummeted.

Even numerous specialist millennials now view homeownership as a wishful thinking, specifically in Sydney and Melbourne.

As a result, even more young people are remaining in their household home longer – almost 60 % of 18 – to 24 -year-olds still deal with their parents, and less are forming relationships or having kids prior to the age of 30

This isn’t simply a lifestyle choice.

It’s a reaction to affordability stress and economic precarity.

The standard life course – task, partner, home, youngsters – is being postponed, or in some cases, rewritten entirely.

Deviating experiences: gender and location issue

There’s no solitary “young people” experience in Australia any longer.

For instance, young women are gaining more than their male peers in early occupations, driven by greater academic attainment and growth in female-dominated markets like health care.

However they’re additionally experiencing decreasing mental health and greater levels of isolation and hospitalisation.

At the same time, some boys, particularly in local areas, are falling back, encountering higher unemployment, lower education prices, and increasing rates of disengagement.

And the divide doesn’t stop there.

In some remote locations, up to 30 % of 20– 24 -year-olds are not in work, education and learning or training. That’s a huge pool of untapped possibility.

The mental wellness and innovation double-whammy

Youthful Australians are additionally the very first generation to mature completely online.

They have actually accessed to more information, even more selection, more chance.

However they’ve also inherited a collection of new issues: social networks addiction, raised anxiety, and declining mental well-being.

Psychological health ratings for girls have actually dropped substantially over the last decade.

And young men are revealing signs of risky practices in various other locations – gambling, for example, has increased amongst young men given that 2015, and remarkably, it’s not just on the internet wagering – it’s pokies.

Simply put, modern technology has improved how young Australians communicate, develop relationships, and take risks, yet not constantly for the better.

The inheritance economy however only for some

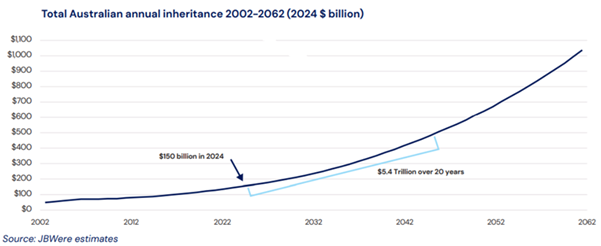

Australia is on the verge of the most significant riches transfer in its history.

Inheritances are anticipated to quadruple by 2050

However, these gains will certainly be unevenly distributed; lots of will obtain little or absolutely nothing, and they commonly arrive far too late to support early economic landmarks.

JBWere estimates that some $ 5 4 trillion of this wide range will be transferred to more youthful generations over the following two decades.

Nonetheless, this won’t be handed down to Gen Z or millennials anytime quickly– it will certainly be passed on to their parents.

And while some young Australians will eventually capture up with bequests and asset admiration, others will not.

And that can seal a brand-new sort of inequality, not simply between generations, but within them.

So … are they far better off?

That depends.

If we’re determining in raw education degrees, life expectancy, or accessibility to electronic tools – indeed, young Australians have actually obtained an edge.

But if we’re speaking about financial self-reliance, homeownership, connection security, or psychological health and wellbeing, numerous young Australians are encountering a much rougher roadway.

Actually, the story isn’t one of decrease , but hold-up

Life landmarks are being pushed back, improved, and in some cases, reimagined.

According to the E 61 Institute report, the obstacle for policymakers is recognizing these shifts and preparing for what comes next.

Last ideas for residential property capitalists and entrepreneur

Why does this issue to you as a home financier or entrepreneur?

Due to the fact that comprehending generational adjustment offers you understanding into tomorrow’s housing market, workforce, and economy.

Youthful Australians might be getting later on, renting out much longer, and starting families in their 30 s- yet that does not indicate they won’t build wealth.

They’ll just do it in a different way. Some will certainly inherit, some will invest, others will certainly co-buy or rentvest.

But they’ll still need homes. They’ll still chase monetary freedom. And they’ll still be seeking possibilities in a quickly changing globe.

Your work is to see the fads early, adapt, and invest accordingly.