Key takeaways

Buyers are cheering up, rate growth has actually lifted, public auction clearance prices are climbing and supply is tightening.

Undoubtedly, current signals suggest we are heading for a really interesting Spring selling period.

The concern is that buyers are commonly quicker to reply to changes than sellers.

Across the significant resources city markets, there are currently around 68 k listings, a 15 year low equal to 2 1/2 months of sales– we are usually closer to 3 1/2 months. Monthly new listings are delaying sales by about 7 5 k. If demand increases 10 – 15 % from right here, sparks may fly.

This week, Cotality additionally reports that:

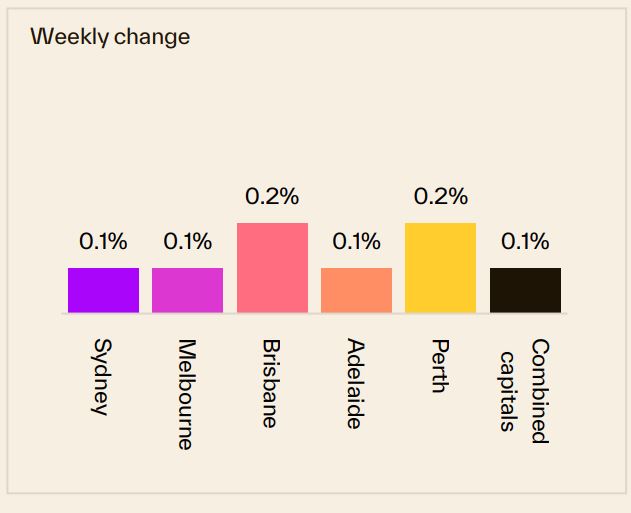

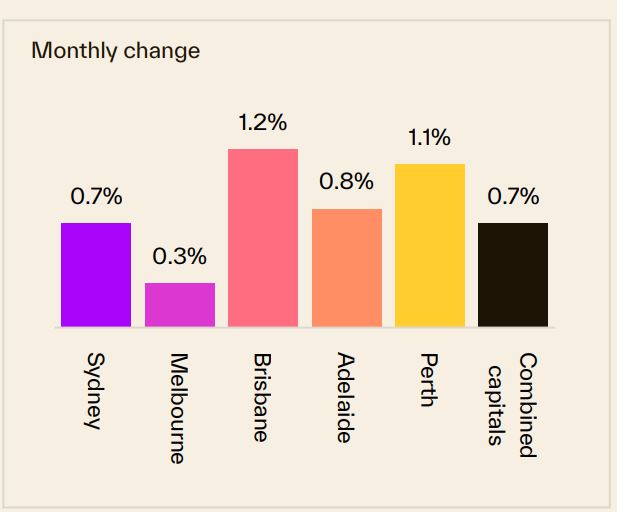

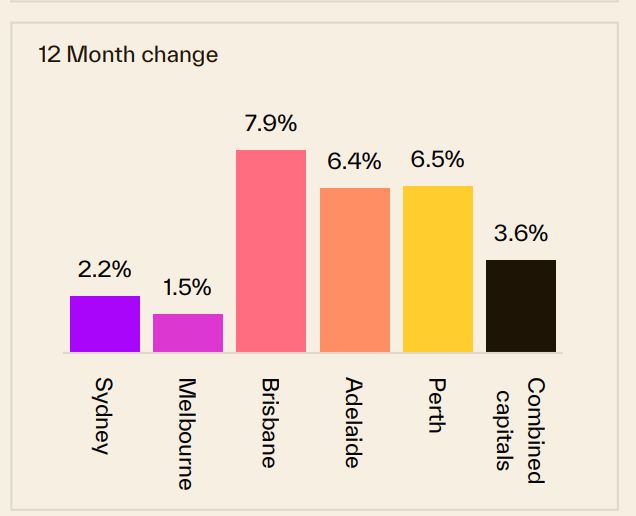

* Sydney property prices boosted 0. 1 % over the last week, enhanced 0. 7 % over the last month and are 2 2 % higher than they were 12 months ago.

* Melbourne residential property costs boosted 0. 1 % over the last week, boosted 0. 3 % over the last month, and increased 1 5 % compared to 12 months back.

* Brisbane residential or commercial property prices increased 0. 2 % over the recently, enhanced 1 2 % over the last month and are 7 9 % more than they were 12 months back.

Overall, Australian capital dwelling costs increased 0. 7 % over the last month and are now 3 6 % greater than they were 12 months back.

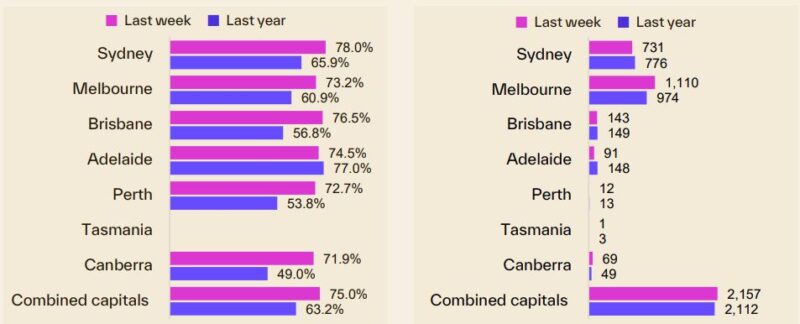

There were 2, 157 residential properties required to public auction throughout the mixed resources, a 1 5 % dip on the previous week, yet the 3rd week in a row where more than 2, 000 public auctions were held.

The preliminary public auction clearance rate has actually additionally shown a slight fade, can be found in at 75.0% last week, down 1 3 percent factors from the week prior.

This present home cycle has actually been driven by an undersupply of great residential or commercial properties relative to present need raising property worths and leas there was absolutely nothing to suggest there will be any type of substantial modification in the near future.

However, the undersupply residential properties is going to continue for a long time with all commentators agreeing that there is no chance we’re mosting likely to hit the real estate construction targets required to meet our demand.

Westpac’s Real estate Pulse reported a discernible shift in Australia’s housing markets

Customers are perking up, price growth has raised, auction clearance rates are increasing, and supply is tightening.

Indeed, existing signals suggest we are going to an extremely fascinating Spring selling period.

Housing-related view has transformed. Westpac’s ‘time to get a residence’ index surged a further 10 % in August, buoyed by a third 25 bp interest rate reduced from the RBA and a clearer signal that some more reducing can be expected.

Home rate expectations remain favorable, and joblessness assumptions point to little issue about tasks.

Westpac report that it is not rather ‘all systems go’– consumer risk aversion is still elevated– however customers are typically quicker to respond to adjustments than vendors.

Throughout the significant funding city markets, there are presently around 68, 000 listings, a 15 year reduced equivalent to 2 1/2 months of sales– we are normally closer to 3 1/2 months.

Month-to-month brand-new listings are delaying sales by regarding 7 5 k. If demand increases 10 – 15 % from right here, stimulates may fly.

On the public auction front today … auction task is set to increase across consolidated fundings

Last week saw 2, 157 buildings taken to auction throughout the combined resources, a 1 5 % dip on the previous week, yet the 3rd week straight where greater than 2, 000 auctions were held.

The preliminary auction clearance price has actually additionally shown a slight discolor, can be found in at 75.0% last week.

See Cotality’s full public auction record listed below.

Today, Cotality likewise reports that:

- Sydney home costs boosted 0. 1 % over the recently, increased 0. 7 % over the last month and are 2 2 % greater than they were 12 months earlier.

- Melbourne home prices enhanced 0. 1 % over the last week, boosted 0. 3 % over the last month, and increased 1 5 % contrasted to 12 months earlier.

- Brisbane residential or commercial property prices boosted 0. 2 % over the last week, raised 1 2 % over the last month and are 7 9 % greater than they were 12 months earlier.

Overall, Australian funding residence rates enhanced 0. 7 % over the last month and are now 3 6 % more than they were 12 months back.

Plainly, the building cycle is carrying on but our markets are very fragmented.

Source: Cotality September 8 th 2025

Certainly, these are “overall” numbers – there is not one Sydney or Melbourne or Brisbane home market.

And numerous segments of each market are doing in a different way.

At the beginning of this cycle the top quartile of the marketplace lead the growth however in 2014 the lower quartile throughout every capital city tape-recorded a more powerful outcome for real estate values about its top quartile equivalent.

The following chart demonstrates how numerous sectors of each resources city market are performing differently with median-priced homes performing well.

To help keep you up-to-date with all that’s taking place in building, right here is my updated once a week analysis of information and graphes since 8 th September 2025 given by SQM Research, Cotality , and realestate.com.au

Present residential or commercial property asking rates

Residential property asking prices are a valuable leading indicator for real estate markets – providing a good indication of what’s ahead.

Right here is the latest information available:

Sydney

| Residential or commercial property type | Cost ($) | Weekly Change | Monthly Modification % | Yearly % adjustment |

|---|---|---|---|---|

| All Homes | 2, 061, 082 | 9 917 | 1 4 % | 7 5 % |

| All Systems | 867, 029 | 9 271 | -0. 6 % | 6.0% |

| Incorporated | 1, 574, 659 | 9 654 | 0. 9 % | 6 9 % |

Source: SQM Research study

Melbourne

Resource: SQM Research

Brisbane

| Residential property type | Cost ($) | Weekly Adjustment | Month-to-month Adjustment % | Yearly % adjustment |

|---|---|---|---|---|

| All Houses | 1, 279, 750 | 3 303 | 1 4 % | 10 4 % |

| All Systems | 751, 179 | -0. 479 | 1 1 % | 16 7 % |

| Integrated | 1, 146, 770 | 2 352 | 1 4 % | 11 3 % |

Source: SQM Research

Perth

| Property type | Rate ($) | Weekly Change | Regular monthly Modification % | Annual % adjustment |

|---|---|---|---|---|

| All Residences | 1, 172, 705 | 6 984 | 1 2 % | 10 3 % |

| All Devices | 662, 165 | -0. 737 | 1 1 % | 19 1 % |

| Combined | 1, 038, 903 | 4 960 | 1 2 % | 11 6 % |

Resource: SQM Research study

Adelaide

| Home type | Price ($) | Weekly Modification | Monthly Modification % | Annual % modification |

|---|---|---|---|---|

| All Houses | 1, 058, 321 | 4 352 | 0. 7 % | 11 9 % |

| All Systems | 568, 192 | -0. 992 | 0. 4 % | 21 5 % |

| Incorporated | 966, 342 | 4 189 | 0. 7 % | 13 5 % |

Resource: SQM Research

Canberra

| Residential or commercial property kind | Cost ($) | Weekly Modification | Month-to-month Adjustment % | Annual % modification |

|---|---|---|---|---|

| All Residences | 1, 229, 927 | – 6 565 | 0. 3 % | 4 6 % |

| All Systems | 588, 940 | -0. 203 | -0. 5 % | -0. 3 % |

| Integrated | 990, 162 | – 4 185 | 0. 1 % | 2 9 % |

Resource: SQM Research study

Darwin

| Residential property kind | Cost ($) | Weekly Change | Monthly Adjustment % | Annual % adjustment |

|---|---|---|---|---|

| All Homes | 788, 039 | – 2 039 | – 1 2 % | 20 6 % |

| All Devices | 437, 318 | – 6 318 | 1 2 % | 14 5 % |

| Integrated | 650, 178 | – 3 721 | -0. 6 % | 18 9 % |

Source: SQM Research study

Hobart

| Residential property type | Cost ($) | Weekly Adjustment | Month-to-month Adjustment % | Yearly % modification |

|---|---|---|---|---|

| All Homes | 851, 013 | 5 168 | 1 7 % | 7 6 % |

| All Devices | 495, 424 | – 1 124 | 0. 3 % | 0. 6 % |

| Combined | 796, 809 | 4 209 | 1 6 % | 6 9 % |

Resource: SQM Research study

National

| Residential or commercial property kind | Rate ($) | Weekly Change | Month-to-month Change % | Annual % modification |

|---|---|---|---|---|

| All Residences | 1, 020, 854 | 7 671 | 1 1 % | 9 2 % |

| All Units | 599, 086 | 1 698 | 1.0% | 7 7 % |

| Incorporated | 929, 536 | 6 378 | 1 1 % | 8 8 % |

Source: SQM Study

Cap City Average

| Residential or commercial property kind | Rate ($) | Weekly Adjustment | Monthly Modification % | Yearly % adjustment |

|---|---|---|---|---|

| All Homes | 1, 498, 173 | 3 037 | 1 3 % | 7 8 % |

| All Devices | 752, 018 | 11 074 | 0. 3 % | 8 9 % |

| Incorporated | 1, 275, 703 | 5 433 | 1 1 % | 7 8 % |

Resource: SQM Research study

The value of property asking costs as a leading indicator for real estate markets is fairly considerable.

Actually it’s more valuable than median costs which can be quite misleading.

Allow’s look into why this holds true and just how it influences the property market.

- Early Market Sentiment Indicator : Asking prices usually mirror the existing sentiment of vendors in the realty market.

If sellers are certain, they might establish higher asking rates, preparing for strong demand.

Alternatively, if vendors doubt or view a market recession, they may decrease their asking prices to attract buyers.

This makes asking costs a real-time indicator of market sentiment, frequently preceding modifications in real sales prices. - Anticipating of Future Cost Trends : Patterns in asking costs can be anticipating of where the actual property costs are headed.

For instance, a regular surge in asking rates over a duration can signal an upcoming increase in deal rates. - Effect of Economic Factors : Economic aspects such as rate of interest, employment rates, and wider economic wellness influence asking costs.

For example, modifications in the Get Financial institution of Australia’s policies or shifts in the work market can rapidly reflect in the asking costs, providing understandings into exactly how these aspects are influencing the housing market. - Regional Variations : In a varied market like Australia’s, asking prices can likewise supply insights right into regional variations.

For example, the property markets in Melbourne and Sydney might behave differently from those in Brisbane or Perth. Asking rates can provide very early indicators of these regional fads. - Influence of Supply and Demand : Asking rates are additionally a feedback to the balance of supply and need in the market.

In areas with minimal supply and high demand, asking rates tend to be greater and vice versa.

However, it’s important to note that while asking prices are a useful sign, they need to not be made use of in isolation.

Various other factors like actual sales prices, time on the marketplace, auction clearance prices, and financial conditions likewise play important functions in understanding the home market characteristics.

FOUND OUT MORE: The latest median home prices in Australia’s major cities

Last weekend’s auction record

Auction activity set to raise throughout combined capitals

Last week saw 2, 157 buildings taken to auction across the consolidated capitals, a 1 5 % dip on the previous week, however the 3rd week in a row where more than 2, 000 auctions were held.

The number of public auctions will rise to around 2, 440 this week, climbing to approximately 2, 600 following week.

The preliminary public auction clearance price has actually additionally shown a minor discolor, coming in at 75.0% last week, down 1 3 percent factors from the week prior.

This was the fourth straight week where the mixed resources preliminary clearance price has actually held at the 75.0% mark or greater.

Melbourne saw 1, 110 homes required to auction recently, up 2 6 % on the previous week to be the highest quantity because the initial week of June earlier this year.

There are presently around 1, 170 public auctions set up for Melbourne today, rising to around 1, 200 next week.

The preliminary clearance rate slipped to 73 2 % recently, the lowest in 4 weeks, yet likewise the 19 th consecutive week where the initial clearance price has held at 70 % or higher.

Sydney held 731 auction occasions last week, down 9 8 % from the week prior.

The volume is readied to climb this week, with around 930 homes arranged for auction, and is likely to rise over the 1, 000 mark the adhering to week.

The preliminary clearance rate came in strong at 78.0% recently, which was the highest possible among the fundings however a mild dip on the previous week (80 3 %).

There were 143 auctions held in Brisbane last week, up from 123 the previous week.

The preliminary clearance rate got to 76 5 % which was the greatest considering that July 2024

Adelaide organized 91 auctions last week, a close to 12 % decrease from the week prior.

74 5 % of auctions have actually tape-recorded a successful outcome on the collection to-date, down from 75.0% the week prior and the fifth straight week where the initial clearance rate has held above 70 %.

In Canberra , 69 homes were auctioned recently, returning a 71 9 % preliminary clearance price, the most affordable

in five weeks.

There were 12 homes auctioned across Perth recently, with 72 7 % reporting a successful result up until now.

Just one home was taken to auction in Tasmania last week, and it sold under the hammer.

Our rental markets

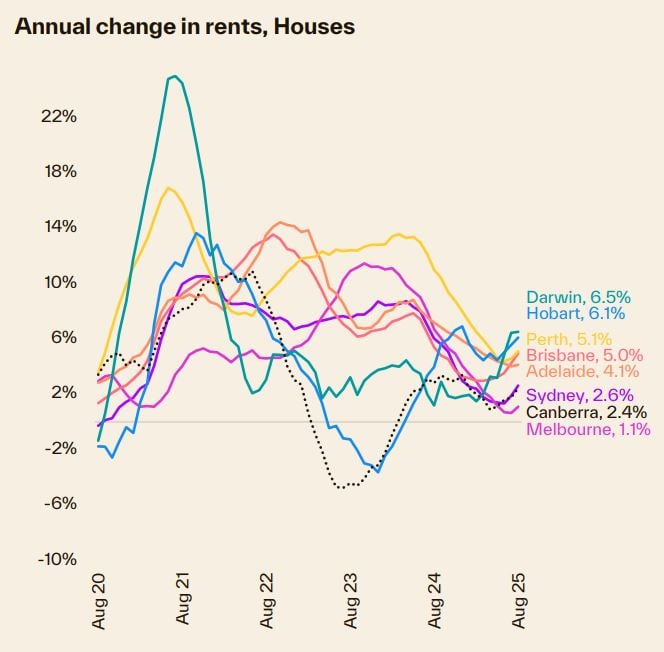

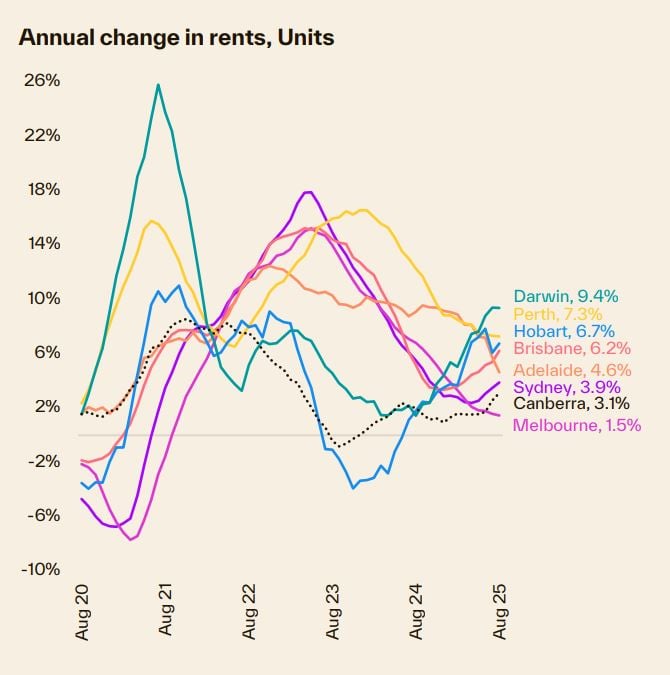

According to Cotality, nationwide rental growth grabbed to 0. 5 % in seasonally readjusted terms with August, the largest month on month surge given that May in 2015.

The re-acceleration in rental development has actually appeared via the majority of 2025, with the annual adjustment currently climbing over two successive months, getting to 4 1 % in August.

Rental markets stay incredibly limited throughout many regions, with the nationwide vacancy rate at 1 5 % in August which is around record lows.

The five years before 2020 recorded a typical vacancy rate of 3 3 %, greater than double the present degree.

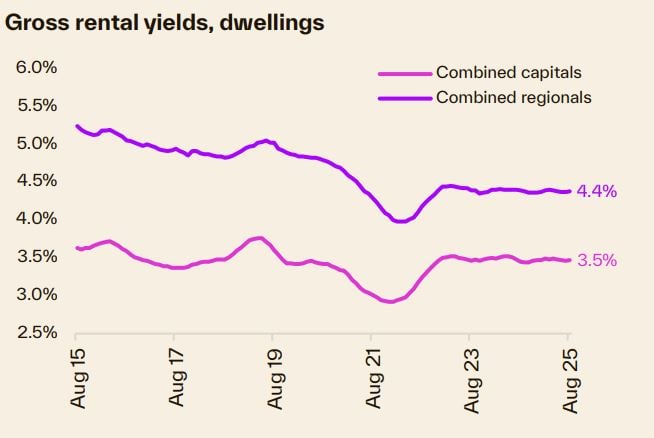

Despite the continuous surge in rental values, gross rental returns have actually held reasonably firm since the start of 2023,

adhering to the decrease in yields when worth growth considerably exceeded rental growth through the pandemic.

Sydney

| Home Kind | Rent ($) | Weekly adjustment | Monthly modification | 12 Months alter |

|---|---|---|---|---|

| All Homes | $ 1, 078 89 | – 6 89 | 0. 1 % | 4 9 % |

| All Units | $ 715 53 | 1 47 | 0. 9 % | 3 5 % |

| Integrated | $ 862 88 | – 1 93 | 0. 5 % | 4 2 % |

Source: SQM Study

Melbourne

| Building Kind | Rental Fee ($) | Weekly modification | Regular monthly adjustment | 12 Months alter |

|---|---|---|---|---|

| All Houses | $ 765 28 | – 1 28 | -0. 3 % | 2 4 % |

| All Units | $ 576 27 | -0. 27 | 0. 2 % | 3 1 % |

| Integrated | $ 655 10 | -0. 62 | 0.0% | 2 9 % |

Resource: SQM Research

Brisbane

| Residential property Kind | Rental Fee ($) | Weekly adjustment | Month-to-month change | 12 Months transform |

|---|---|---|---|---|

| All Residences | $ 774 91 | 0. 09 | 0. 4 % | 7 4 % |

| All Units | $ 613 09 | – 1 09 | 0. 8 % | 7 1 % |

| Incorporated | $ 702 07 | -0. 44 | 0. 6 % | 7 3 % |

Source: SQM Research study

Perth

| Home Type | Rent ($) | Weekly adjustment | Month-to-month adjustment | 12 Months change |

|---|---|---|---|---|

| All Residences | $ 818 13 | – 1 13 | – 1 4 % | 5.0% |

| All Devices | $ 650 49 | -0. 49 | -0. 2 % | 6 6 % |

| Combined | $ 748 72 | -0. 83 | – 1.0% | 5 6 % |

Source: SQM Research

Adelaide

| Home Type | Lease $) | Weekly adjustment | Regular monthly change | 12 Months alter |

|---|---|---|---|---|

| All Houses | $ 669 07 | -0. 07 | -0. 3 % | 1 1 % |

| All Devices | $ 533 28 | 0. 72 | 2 1 % | 5 4 % |

| Combined | $ 623 05 | 0. 23 | 0. 4 % | 2 4 % |

Resource: SQM Research

Canberra

| Residential property Type | Lease ($) | Weekly change | Regular monthly modification | 12 Months alter |

|---|---|---|---|---|

| All Homes | $ 780 05 | 1 95 | 0. 3 % | 0. 3 % |

| All Systems | $ 571 56 | – 3 56 | – 2 3 % | 2 5 % |

| Combined | $ 665 99 | – 1 13 | -0. 9 % | 1 2 % |

Source: SQM Research

Darwin

| Home Kind | Rental Fee ($) | Weekly adjustment | Monthly adjustment | 12 Months change |

|---|---|---|---|---|

| All Houses | $ 757 19 | 4 81 | – 3 5 % | 1 3 % |

| All Systems | $ 578 02 | 2 98 | 3 2 % | 16 7 % |

| Integrated | $ 651 21 | 3 76 | -0. 1 % | 8 9 % |

Source: SQM Research study

Hobart

| Home Type | Rent 9 $) | Weekly modification | Regular monthly change | 12 Months transform |

|---|---|---|---|---|

| All Houses | $ 582 29 | 6 71 | -0. 4 % | 9 5 % |

| All Systems | $ 513 23 | – 1 23 | 3 1 % | 12 4 % |

| Incorporated | $ 554 72 | 3 55 | 0. 9 % | 10 6 % |

Resource: SQM Research study

National

| Residential or commercial property Kind | Rent ($) | Weekly modification | Regular monthly modification | 12 Months transform |

|---|---|---|---|---|

| All Houses | $ 724 00 | – 5 00 | 0. 3 % | 4 6 % |

| All Systems | $ 572 00 | 1 00 | 0. 5 % | 4 6 % |

| Combined | $ 653 54 | – 2 20 | 0. 4 % | 4 6 % |

Resource: SQM Study

Cap City Average

| Residential property Kind | Rent ($) | Weekly modification | Monthly modification | 12 Months transform |

|---|---|---|---|---|

| All Homes | $ 862 00 | – 5 00 | -0. 7 % | 3 9 % |

| All Units | $ 647 00 | – 1 00 | 0. 5 % | 4 4 % |

| Combined | $ 749 70 | – 2 85 | -0. 2 % | 4 1 % |

Source: SQM Research

Vendors of great residential properties are on strike

The circulation of recently marketed listings has actually continued to track well poor (- 8 8 %) through July, with just 32, 481 newly listed properties across the country over the 4 weeks to August 3 rd.

Although we generally see less brand-new listings assumed winter season, present numbers are – 11 5 % below the degrees seen this time in 2014 and are approximately in line (-0. 4 %) with those seen in 2020 in the middle of covid lockdowns and checking out constraints.

With the flow of freshly promoted listings holding well poor, overall stock levels have remained to decline, with properties being absorbed faster than they are contributed to the market.

Over the four weeks to August 3 rd, Cotality observed 121, 113 complete listings country wide, – 9 5 % listed below the matters seen this time around in 2015 and – 19 4 % less than the typical degrees generally seen this time of year.

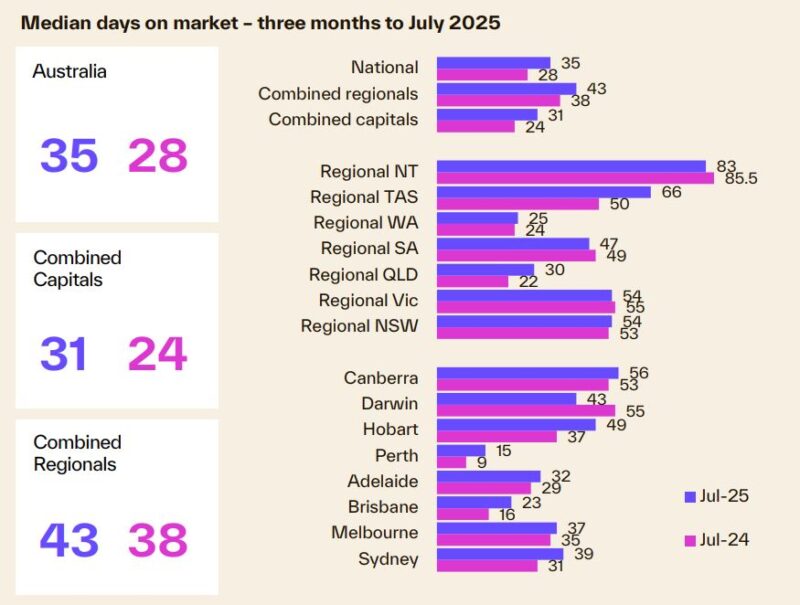

Vendor metrics

As the following graph programs, it’s taking longer to market a home.

The national average time on market increased to 35 days over the 3 months to July after briefly dipping to 30 days over the 3 months to April.

About this time last year, offering times have increased throughout all fundings other than Darwin (43 days, down 12 days).

Hobart (49 days) saw the largest rise in average days on market, complied with by Sydney (39 days) and Brisbane (23 days), up twelve, 8 and 7 days, respectively.