Trick takeaways

RBA price reduced in August has added fuel to already strong housing energy, improving price and enhancing buyer/seller self-confidence.

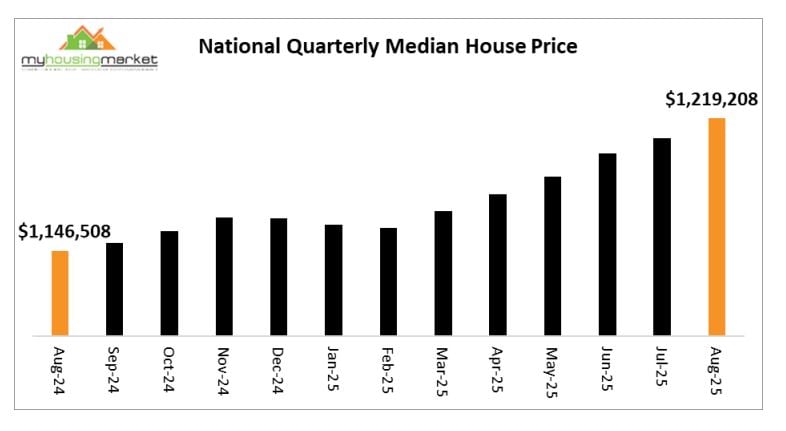

Home costs climbed across the country for the sixth successive month, up 0. 9 % for the quarter to a median of $ 1, 219, 208, now 6 3 % higher year-on-year.

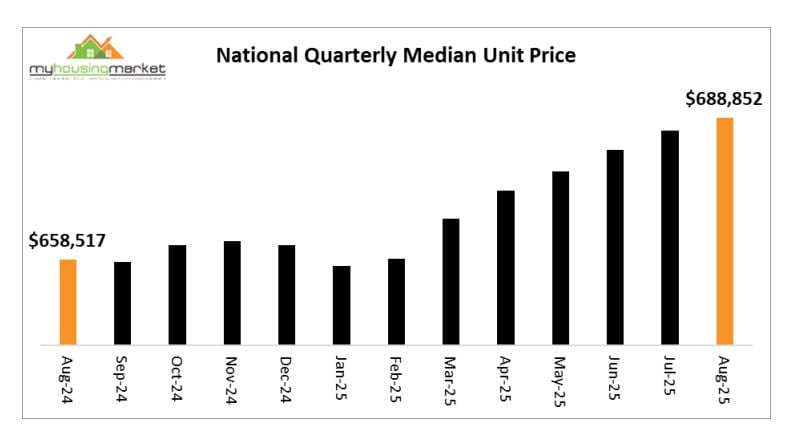

System prices also rose, marking their seventh straight monthly rise, up 0. 6 % to $ 688, 852, 4 6 % greater year-on-year.

Anticipate continued solid cost growth, led by Brisbane, Perth, and Adelaide, likely surpassing 10 % every year for both residences and devices.

An additional RBA price cut possible in 2025 if inflation and work markets enable, further improving housing markets.

The commonly awaited choice by the RBA to reduce official interest rates over August has contributed to momentum in already durable real estate markets, with most capitals once again reporting higher house prices over the August quarter compared to the previous July quarter.

The national capital city average house rate raised by 0. 9 % over the August quarter to $ 1, 219, 208 contrasted to the July quarter, according to the most recent information from My Real estate Market.

The August result was the 6th consecutive month-to-month surge in nationwide prices with yearly house prices continuing to accelerate and now higher by 6 3 % over the past year.

The majority of fundings reported residence cost rises over August with the resurgent Darwin once again the top entertainer higher by 3 6 % adhered to by Brisbane up 2 2 %, Sydney higher by 1 4 %, Adelaide up 0. 8 %, Perth increased 0. 6 %, Canberra higher by 0. 2 % with Melbourne and Hobart lower– down by 0. 1 % and 0. 4 % respectively.

Darwin, Brisbane and Perth have reported the greatest residence rate rises over the past year – higher by 16 3 %, 11.0% and 9 9 % respectively.

Quarterly Median Residence Rates August 2025

| Typical | Month | This Year | 1 Year | 2 Year | |

| Sydney | $ 1, 729, 426 | 1 4 % | 4 5 % | 5 9 % | 12 5 % |

| Melbourne | $ 1, 082, 701 | -0. 1 % | 3.0% | 3 1 % | 1 7 % |

| Brisbane | $ 1, 085, 235 | 2 2 % | 8 1 % | 11.0% | 29 1 % |

| Adelaide | $ 1, 025, 066 | 0. 8 % | 5 2 % | 6 7 % | 25 1 % |

| Perth | $ 1, 020, 282 | 0. 6 % | 5 4 % | 9 9 % | 39 9 % |

| Hobart | $ 704, 816 | -0. 4 % | 3 2 % | 5 1 % | 5 8 % |

| Darwin | $ 710, 799 | 3 6 % | 13 6 % | 16 3 % | 8 6 % |

| Canberra | $ 978, 479 | 0. 2 % | 2 5 % | 4 4 % | 1.0% |

| National | $ 1, 219, 208 | 0. 9 % | 4 7 % | 6 3 % | 14 5 % |

Apartment Or Condo/ Unit Market Update

National device costs were also higher again over the August quarter for the seventh consecutive month, rising by 0. 6 % to $ 688, 852 to continue to be 4 6 % greater than the August quarter 2024 result.

Adelaide was the top month-to-month performer with device prices increasing over August by 2 2 % followed by Brisbane up 1 8 %, Canberra increased 0. 9 %, Perth higher by 0. 8 %, Melbourne up 0. 7 %, Darwin higher by 0. 3 % with Sydney lower by 0. 1 %.

Quarterly Mean Unit Rates August 2025

| Typical | Month | This Year | 1 Year | 2 Year | |

| Sydney | $ 796, 938 | -0. 1 % | 2 7 % | 2 8 % | 7 3 % |

| Melbourne | $ 576, 839 | 0. 7 % | 2 8 % | 1 9 % | 3 1 % |

| Brisbane | $ 636, 598 | 1 8 % | 10 8 % | 15 6 % | 44 5 % |

| Adelaide | $ 586, 579 | 2 2 % | 11 4 % | 12 3 % | 35 8 % |

| Perth | $ 564, 118 | 0. 8 % | 10.0% | 14 3 % | 46 7 % |

| Hobart | $ 503, 853 | – 1 5 % | – 3.0% | – 3 6 % | – 4 6 % |

| Darwin | $ 372, 772 | 0. 3 % | 4 3 % | 2 9 % | 1 4 % |

| Canberra | $ 517, 661 | 0. 9 % | 3 3 % | 3 5 % | 1 8 % |

| National | $ 688, 852 | 0. 4 % | 4 1 % | 4 6 % | 11 3 % |

Brisbane, Perth and Adelaide have tape-recorded clearly the highest yearly device rate development for many years ending the August quarter 2025 up by 15 6 %, 14 3 %, and 12 3 % specifically.

Capital city housing markets have continued to report typically favorable results over the August quarter with many fundings videotaping higher prices for both houses and systems.

The RBA price cut over August adhering to the decreases of February and May, has actually included in increasing real estate market power by again enhancing price and sustaining currently heady buyer and vendor self-confidence.

Residence rates boosted in the majority of fundings over August with Brisbane the top entertainer of the major cities, and the Perth typical house price remaining to surpass $ 1, 000, 000 – and closing in quickly on Adelaide.

Annual residence rates in a revitalizing Melbourne remain to accelerate and are currently up 3 1 %

Unit cost development also continued to be favorable over August, although general results were once again partially lower contrasted to residences over the month.

Comparable to homes, Melbourne continues to report rising results, with device rates up by 2 8 % over 2025 thus far– a similar outcome to Sydney.

The remainer of 2025 is set to continue to produce favorable results for the majority of capital city housing markets, fuelled by enhanced cost and rising confidence created by lower interest rates.

Costs development in Brisbane, Adelaide and Perth is readied to once more lead capital city results and likely go beyond 10 % each year for both residences and units.

Sydney will certainly to continue to report strong to strong results, with the Melbourne market clearly revitalizing with 2025 rates growth likely to plainly surpass the 2024 outcomes for both homes and systems.

Hidden motorists remain to support housing market activity usually, with the August RBA price reduced likely to be complied with by one more in 2025 if rising cost of living and labour market outcomes continue to sustain lower rates.

The nationwide economy stays strong with jobless prices still low and involvement prices high – and both improved by recent rates of interest cuts.

The proceeded strong performance of retail sales likewise suggests positive customer task and self-confidence.

Although high post-COVID movement levels have actually eased recently, numbers continue to be strong and will certainly add to persistent housing undersupply sustaining high leas and reduced vacancy rates generally in resources city rental markets.

Adhering to a duration of alleviating, the latest information is reporting a basic tightening up of rental job rates and climbing lessee demand, with greater rental fees once more likely to comply with.

High rents and greater rates remain to give clear rewards for very first home purchasers and capitalists going after strong investment returns.

New government initiatives to support first home purchasers will enhance demand and act to place even more upward stress on rates.

Funding city housing markets typically recorded higher house and system prices over 2003 and 2024, and have continued to mostly increase over August regardless of the typical disturbances for winter months market activity.

National home costs are readied to record strong growth once more over 2025 similar at least to the outcomes of the previous 2 years supported by lower interest rates, a proceeding strong economic climate and chronic low degrees of new home building and construction.