Secret takeaways

Do not wager– residential property has to do with basics, not chance.

Ignore incorrect prophets– media projections are sound, concentrate on long-term basics.

Do your due persistance– know what you’re buying and plan for threats.

Take advantage of compounding– time in the market beats timing the marketplace.

Diversify carefully– have a couple of terrific homes, not many typical ones.

Spend defensively– buffers, reasonable debt, and insurance maintain you risk-free.

Spend offensively– when risk-free, proactively expand equity and earnings.

Take care of liquidity– always have a leave approach and financial backup.

Regard expenses– don’t be low-cost, buy high quality recommendations and know-how.

Invest in on your own– expertise is your greatest, most long-lasting possession.

Do you ever feel overwhelmed by all the mixed messages about residential property?

One “specialist” says the marketplace is booming. Another predicts a crash. Rates of interest, inflation, population growth – it can all feel confusing.

And yet, some investors seem to constantly earn money, cycle after cycle.

What do they know that a lot of don’t?

They adhere to a collection of ageless principles. Rules that maintain them risk-free in slumps and thriving in booms.

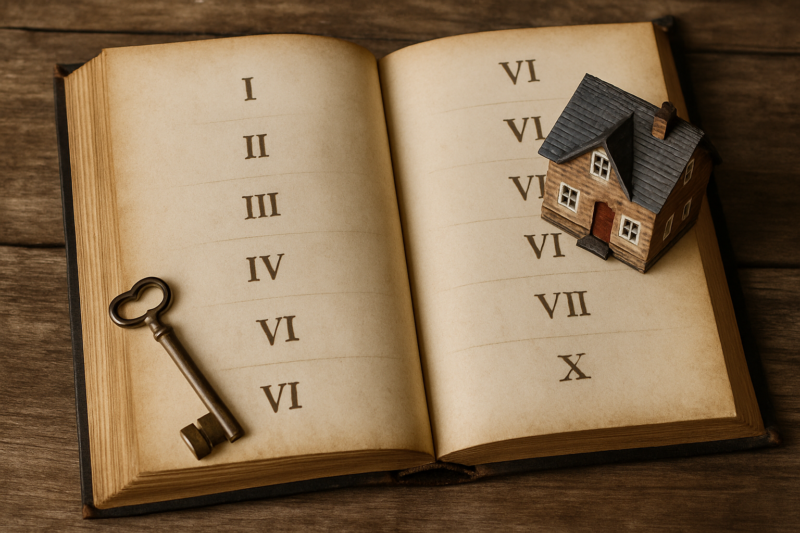

I call them the Ten Commandments of Home Investing

Comply with these and you’ll stay clear of the majority of the blunders that hold investors back.

1 Thou Shalt Not Gamble

Home is not a gambling game.

Winning financiers try to find residential areas and possessions where the odds are stacked in their favour – areas with population development, boosting demographics, facilities investment, limited supply, and solid rental demand.

If you don’t know your side, you’re guessing, not investing.

2 Thou Shalt Forsake The Advice Of False Prophets

Never attempt to outguess the market by adhering to forecasts from the financial media or the latest financial investment master.

Financial forecasts are bit greater than home entertainment, and ought to never ever belong to your investment approach.

And neglect the click-bait headings about “booms” and “busts” or Get-Rich-Quick systems.

Genuine wealth is built by following principles, not forecasts.

The media offers dramatization, not data.

Instead, comply with a proven long-lasting technique and think about where the real estate markets are mosting likely to remain in 10 years’ time, not what’s going to occur over the next few months.

3 Thou Shalt Do Thy Fee Persistance

Only invest in what you understand. If you don’t recognize it, then don’t spend.

What you don’t understand will certainly cost you when spending. Due diligence is the process of gathering info to make informed financial investment choices.

Start with a proven residential property investment technique, and after that make certain you understand the dangers in addition to the benefits of any type of investment you’re about to make.

The very best investors ask: what could go wrong? Then they plan for it prior to purchasing.

Note: I’ve typically stated, “Plan for your plan, not to head to strategy.”

4 Thou shalt worsen returns

Albert Einstein proclaimed substance development the 8th marvel of the globe … and for good factor. Substance development is how the average person can attain phenomenal wealth.

It’s how lots of little things done right can turn into very big outcomes during your lifetime.

Time in the market beats timing the marketplace.

Building wealth is built slowly, through intensifying rental returns and funding growth. Buy the appropriate residential or commercial property, hang on, reinvest, and let the cycle of development repeat. Worsening is how investors transform a single home right into a multi-million dollar residential property profile.

Idea: Permitting compound interest to help you now changes wealth from an inquiry of IF to WHEN.

5 Thou Shalt Diversify, However Not Di-Worse-ify:

Do not place all your eggs in one suburb or one city. Spread your profile across different markets and residential property kinds.

Yet remember, over-diversification is simply “di-worse-ification.”

You don’t need lots of residential or commercial properties; you need a handful of premium, investment-grade ones.

6 Thou Shalt Invest Defensively

Prior to you chase returns, make certain your disadvantage is covered.

Your financial investment technique should have integrated safeguards that take care of risk exposure and control losses to an acceptable degree under both normal problems and worst-case circumstances.

That means having monetary buffers in place to buy you time, not over-leveraging, and insuring correctly.

In residential property, survival is success. If you can ride out the declines, the upturns will certainly care for themselves.

7 Thou Shalt Invest Offensively

At first glimpse, offensive investing could seem contrary to rule # 6

The fact is, they collaborate synergistically to form a full and balanced financial investment technique.

Specified an additional way, you need to invest offensively to look for gains while you spend defensively to manage risk and control losses.

Either fifty percent of this equation without the other is an insufficient financial investment approach.

In fact, offensive and defensive investing are flip-sides of the same coin. No investment method is full without either half of the coin.

As soon as your drawback is covered, you can go on the strike.

Get buildings you can include worth to and afterwards renovate, or embark on small building development tactically, and be proactive in developing equity and rental income, instead of simply kicking back and hoping.

8 Thou Shalt Avoid Illiquidity

The factor liquidity is important is that the threat monitoring device of last option (see Rule # 6 is to market your property.

Certainly, residential or commercial property is a sensibly illiquid possession, so think ahead.

Can you re-finance if needed? Could you sell without taking a haircut?

The very best capitalists always recognize just how they’ll venture out prior to they get in, and have an economic buffer in position to see them via the obstacles the market will certainly present.

9 Thou Shalt Respect, Yet Not Obsess Regarding Expectations

Expenditures are a cost of working.

I’ve seen individuals lose cash due to the fact that they rejected to pay CGT and deal expenses needed to sell an underperforming home.

I have actually also seen people miss out on fantastic financial investment chances as a result of what they assumed appeared to be an expensive Assessment on a great home.