Trick takeaways

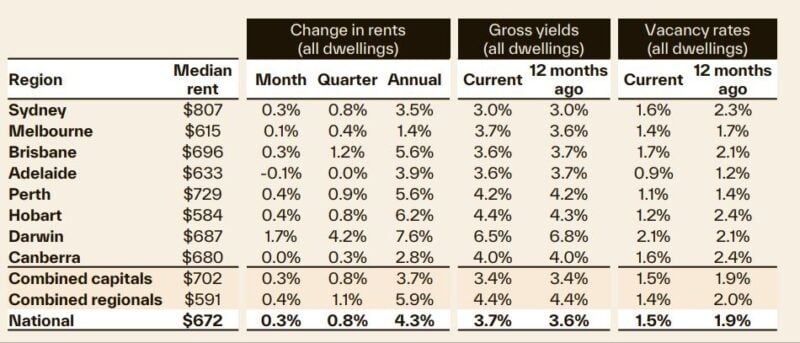

The typical regular rental value throughout Australia’s consolidated funding cities is now $ 702 per week.

Comparative, regional rents stay rather a lot more affordable, holding below the $ 600 mark, with the normal local dwelling renting for $ 591 per week.

Minimal supply continues to be a major catalyst in rising rents, with the variety of rental listings tracking roughly 25 % below the previous five-year ordinary nationally for this moment of year.

Australia’s rental market is seeing restored stamina as national vacancy rates get to a new record-low, according to Cotality’s most recent Quarterly Rental Testimonial.

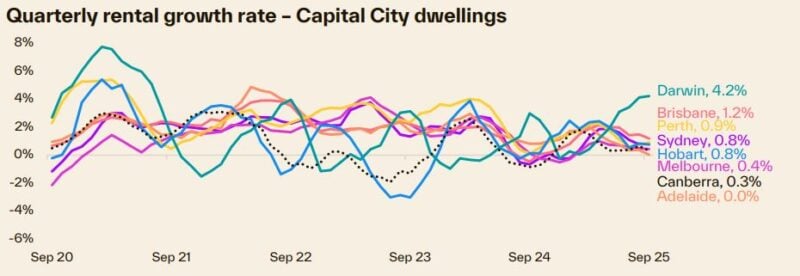

Cotality’s seasonally readjusted Rental Worth Index saw nationwide house rental fees upload a 1 4 % increase in Q 3, its biggest three-month boost because June 2024, and a considerable uptick from the 1 1 % lift tape-recorded in Q 2

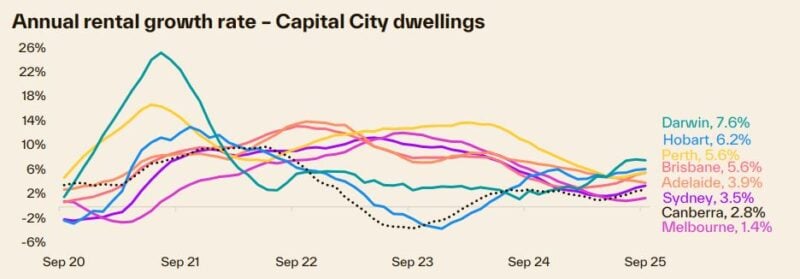

This reacceleration was also noticeable in the yearly pattern, with the 4 3 % increase in rental fees seen over the 12 months to September up 90 basis factors from the four-year low of 3 4 % taped for many years to May.

Brisbane and Sydney led the uptick in the speed of yearly rental growth, up 1 7 and 1 5 percentage factors respectively compared to June, while Adelaide was the only city to see development simplicity, down 90 basis points.

This boosted momentum in rental development was being spurred on by a consistent scarcity in rental supply, highlighted by the record-low openings price seen nationally in September.

Recurring shortage in ‘for lease’ listings, paired with ongoing strength in rental demand has pressed the national job rate to a new document low of 1 47 %– much less than half the pre- COVID years standard of 3 3 %.

Limited supply remains to be a significant catalyst in increasing leas, with the number of rental listings tracking about 25 % listed below the previous five-year ordinary across the country for this time around of year.

Supply is specifically tight in the device sector, especially in Sydney, which taped both a new document low vacancy price throughout its device market and broader house rental market in September at 1 35 % and 1 64 % specifically.

While financiers have consisted of a raised section of home borrowing over the past 2 years, this hasn’t translated right into extra offered rental supply.

Capital city rental fees surpass $ 700 per week

The mean regular rental worth throughout Australia’s consolidated resources cities exceeded the

$ 700 mark for the very first time in August, prior to landing at $ 702 weekly in September.

Comparative, regional leas remain somewhat extra cost effective, holding below the $ 600 mark, with the regular local house renting for $ 591 per week.

This void has actually narrowed over the last few years.

With the regions outshining the resources with the 2nd half of 2024 and into 2025 the affordability advantage offered by regional rental markets has actually minimized from $ 123 in May 2024, to $ 111 in September.

Across the resources, Sydney continues to be without a doubt one of the most costly rental capital, with the regular house leasing for $ 807 each week, while Hobart maintained its title as the country’s most economical city to rent in, with a typical weekly rental worth of $ 584 weekly.

Inflation and cash money price pressure

The current uptick in lease growth is not only bad news for lessees, however it might likewise complicate the inflation and money rate expectation.

The news that rents are once more climbing at a greater price will be undesirable news for renters already battling with the 43 8 % or $ 204 weekly rise in leas seen nationally over the previous 5 years.

Yet it’s probably likewise undesirable news for homeowners and landlords servicing a home loan.”

With “rental fees paid” a key part of the Customer Cost Index (CPI), the enhanced pace of rental value growth seen in recent months can push rising cost of living higher.

Together with some restored upwards pressure from the price of new houses, this renewed momentum in rental fees may result in rising cost of living exceeding RBA projections, which can keep the money price elevated for longer.