Secret takeaways

The real cost of a 5 % deposit: While the scheme aids buyers leap the deposit difficulty, the compromise is a 95 % loan-to-value proportion, suggesting 10s of thousands in additional interest over the life of a 30 -year financing.

Added interest or time in the rental market?: Also larger than LMI financial savings are the moment very first home buyers could save in the rental market. Huge rises in lease values mean a plan that lowers time to conserve a down payment becomes more desirable.

A larger scheme, a larger increase to need: The plan aids individuals purchase sooner, but it’s eventually a demand-side stimulus that does little to deal with why deposits– and currently rents– are so unaffordable in the first place.

Greater rental costs are reshaping the worth proposition of the First Home Assurance, with new evaluation from Cotality comparing the additional price of time in the rental market and potential LMI prices, with the added passion cost of a 5 % down payment home loan.

While the system includes higher interest costs, the savings on lease – especially in cities like Sydney and Brisbane – might surpass the long- term financing concern.

Because its creation, federal home assurance plans have helped over 168, 000 eligible home buyers into home ownership.

Under the First Home Assurance, eligible buyers can buy a home with just a 5 % down payment, while the federal government guarantees the gap to a typical 20 % down payment – helping them prevent lending institutions home mortgage insurance policy, which is typically in the tens-of-thousands of dollars.

Nonetheless, considering that the plan’s intro as the ‘First Mortgage Deposit Scheme’ in January 2020, increasing rental fee prices have put the plan in a new light.

Given that January 2020, the mean weekly lease throughout Australian residences has enhanced an approximated $ 200 weekly, to $ 669 That’s an uplift of over $ 10, 000 each year.

The actual price of a 5 % deposit

First home guarantee systems come at an expense, both to people that take them up, and the broader housing system.

The primary expense for people is extra rate of interest paid over the life of a car loan.

The flipside of a 5 % deposit on a home purchase is a 95 % car loan to value ratio on the home mortgage.

Securing the extra financial obligation implies paying added passion compared to the typical 20 % deposit (Figure 1 shows an illustratory instance based upon the typical dwelling value in Australia).

Mortgage presumptions: a 30 -year principal and passion funding term paid monthly, with long-run rate of interest presumption of 5 5 % per year over the life of the loan. The mortgage price is based upon the existing, new owner-occupier average, readjusted for the August rate cut and undergoes transform.

Over the life of a 30 year finance, the extra interest expenses can be tens-of-thousands, or hundreds-of-thousands much more expensive than a 20 % deposit home mortgage.

Although a smaller sized down payment indicates paying even more rate of interest over time, it could still exercise more affordable for tenants.

Getting involved in a home sooner may imply spending less time paying lease, and those cost savings can accumulate.

The greatest savings throughout the funding cities are estimated to be in Sydney, where a 5 % deposit decreases time to save a deposit by an approximated 6 years, and $ 251, 000 on rental fee at $ 801 per week.

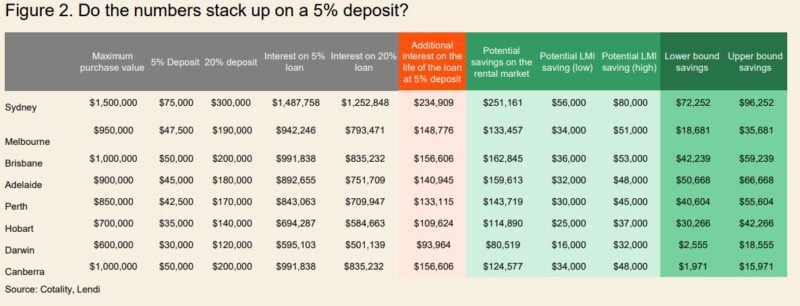

Figure 2 compares the added interest price of a 5 % car loan with prospective LMI and rental financial savings. In this situation, purchasing on top of the system works out much better than costs additional time in the rental market to save up a 20 % down payment.

In fact, the rental cost savings far surpass the cost savings on LMI.

The analysis has a great deal of presumptions (described listed below) and should be taken as a lot more illustrative than guidance regarding whether the scheme works for all people.

For instance, someone that does not have rental costs could locate it much more helpful to conserve up a full 20 % deposit, saving money on both LMI and additional interest prices.

However there are other considerations to take into account even for non-renters, such as getting in the market sooner to get ahead of additional potential market upswings.

Purchase worth is based upon the limit of rate caps in each city.

Mortgage assumptions: a 30 -year principal and passion finance term paid monthly, with long-run rate of interest assumption of 5 5 % per annum over the life of the lending. The 5 5 % figure is based upon the current new owner-occupier rate reported by the RBA, changed for the August price cut, and goes through alter.

Keep in mind on LMI calculations: based upon Lendi LMI Calculator (accessed 2 nd September2025 Whilst every initiative has been made to ensure the accuracy of this calculator, the outcomes ought to be used as indicator only. They are neither a quote nor a pre-qualification for a finance.

Lendi’s LMI Calculator can be accessed right here: https://www.lendi.com.au/calculators/lmi-calculator/

Possible cost savings on the rental market: Thinks the distinction in the time to conserve a 5 % and 20 % deposit, increased by current mean rental prices. Time to conserve a deposit presumes a 15 % cost savings price.

It is very important to note this evaluation stands for the maximum purchase rate and the minimal deposit. Individuals thinking about the system will have a various cost-benefit circumstance depending upon their acquisition rate and deposit size and must consider their very own private conditions.

A larger scheme, a larger boost to need

When the First Home Warranty was presented, we pointed out that the revenue thresholds for accessing the system were relatively high, providing an additional increase to relatively high revenue earners who might have conserved up their 20 % down payment in time.

But targeting the system particularly to reduced revenue families might likewise have been an obstacle to its take-up, since even if reduced revenue homes had their deposit, they might not have gotten a mortgage.

With growth of the plans areas, rate caps and earnings, there will almost certainly be a short-term increase to home worths approximately the limit of the plan, accompanying rates of interest drops and limited degrees of housing supply.

While people on the scheme could jump over the deposit obstacle much faster, this policy is inevitably a need side stimulus which falls short to address why deposits– and currently rents – are so expensive to begin with.