Key takeaways

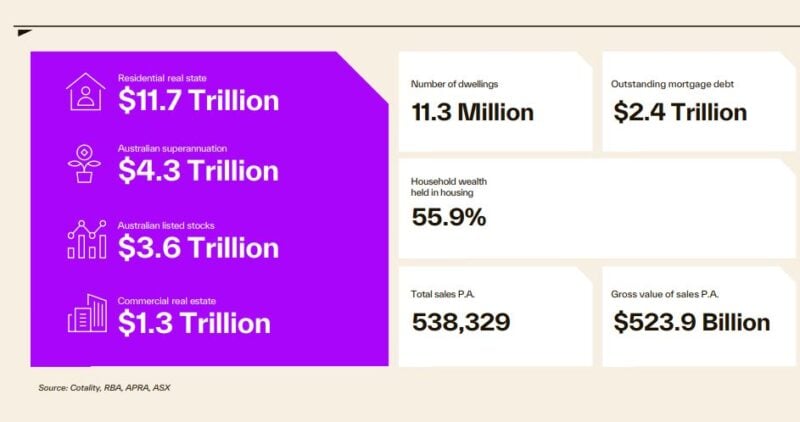

Cotality estimates the mixed value of household real estate climbed to $ 11 7 trillion at the end of August.

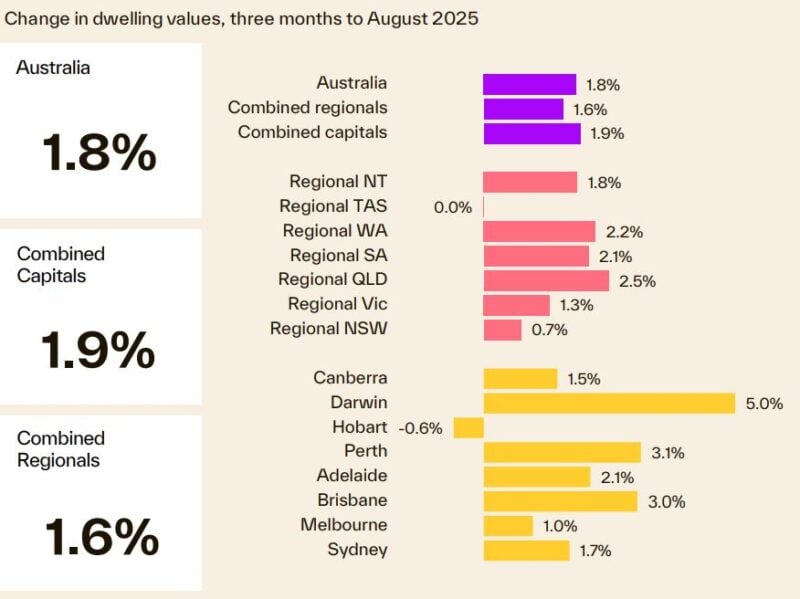

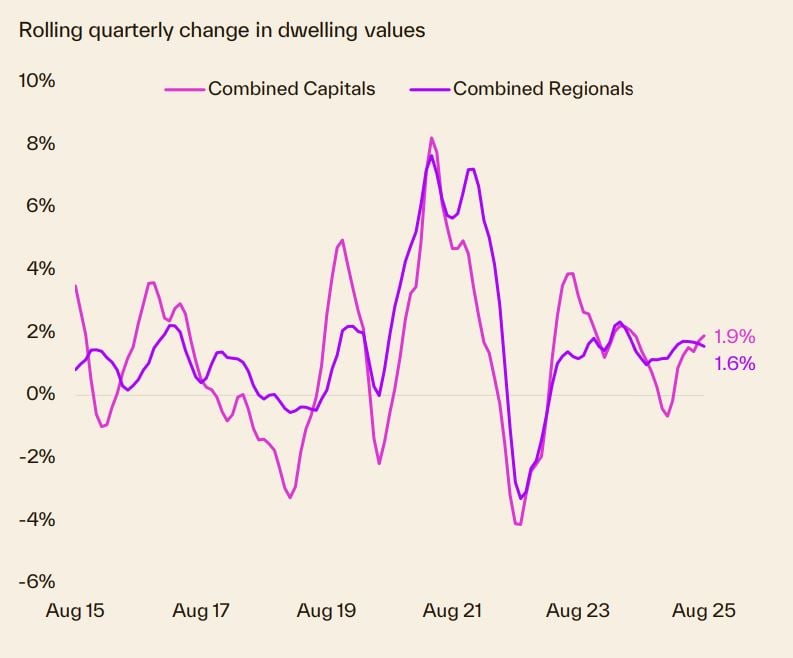

Energy in nationwide housing values has actually remained to build with home values up 1 8 % over the three months to August, the largest quarterly rise given that Q 2 2024 (20%).

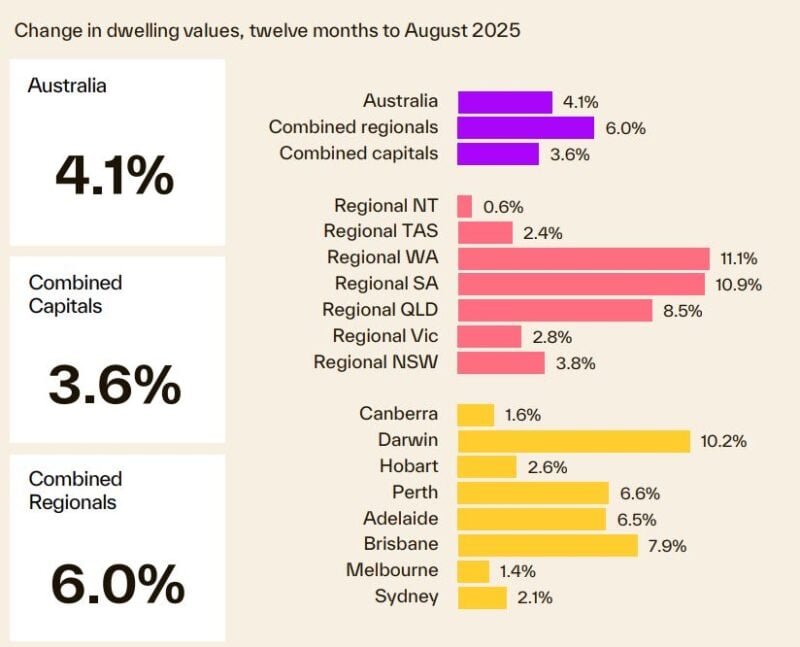

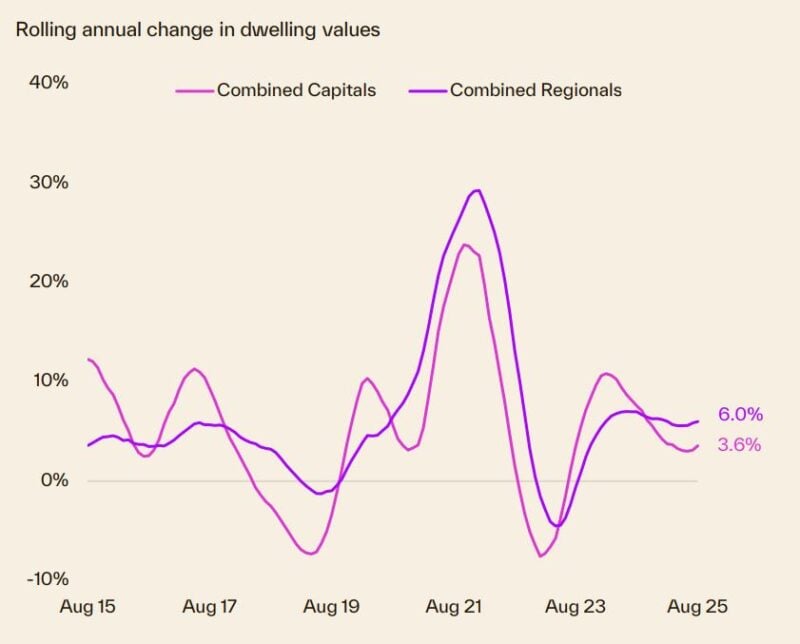

The annual growth pattern additionally moved greater for the second successive month, ramping up from a low of 3 6 % over the 24/ 25 financial year to a 4 1 % increase over the 12 months to August.

Development in one of the most budget-friendly 25 % of combined resources city homes (2 1 %) was surpassed by the middle 50 % of market (2 2 %) in the three months to August. This is substantial due to the fact that the bottom quartile has led market development for almost two years.

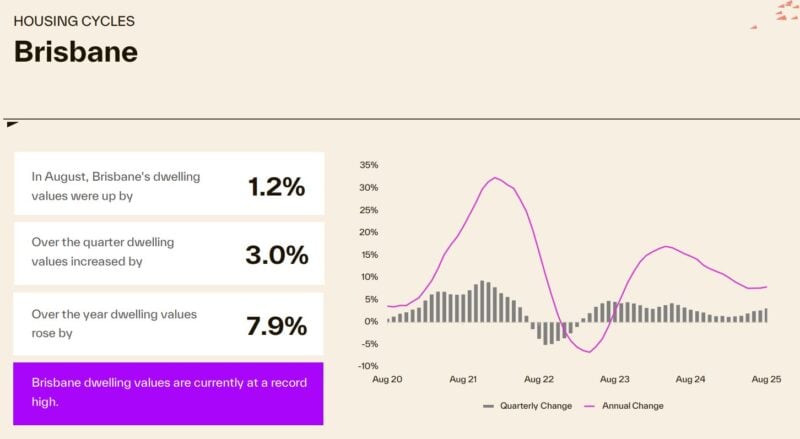

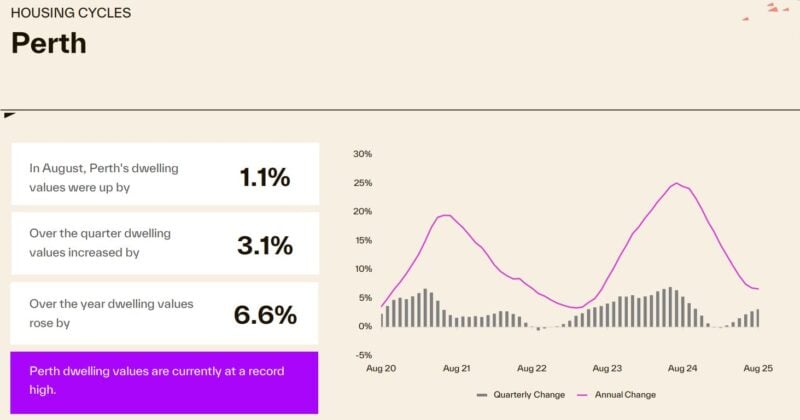

The mid-sized fundings are once again driving growth, with worths in Brisbane and Perth up 1 2 % and 1 1 % specifically in August. Darwin remains to lead the fundings for quarterly and yearly growth, nonetheless, up 5.0% over the three months to August and 10 2 % over the past 12 months.

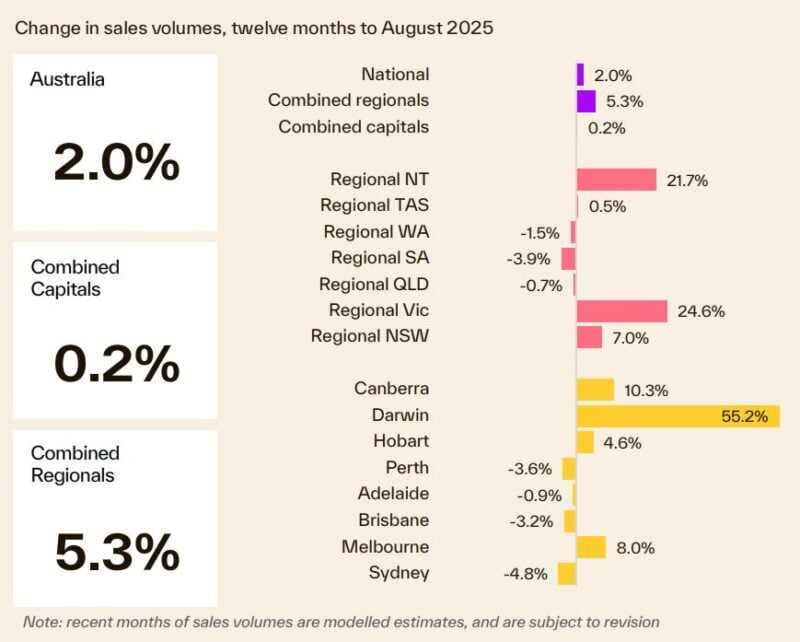

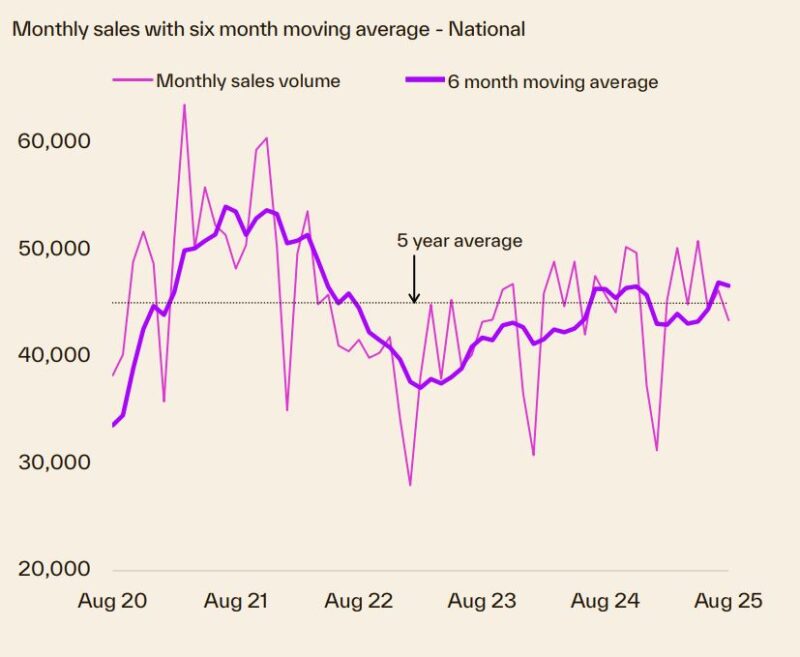

Cotality price quotes 43, 436 sales occurred across the country in August, taking the rolling 12 -month count to 538, 329– 2.0% greater than this moment in 2015 and 3 8 % over the previous five-year average.

While down – 10 3 % from the level seen this moment in 2015, and – 1 3 % timid of the previous five-year standard, listing activity increased 9 4 % in August, effortlessly rate of interest, increasing view and stronger funding gain problems setting the phase for a fracturing spring marketing period.

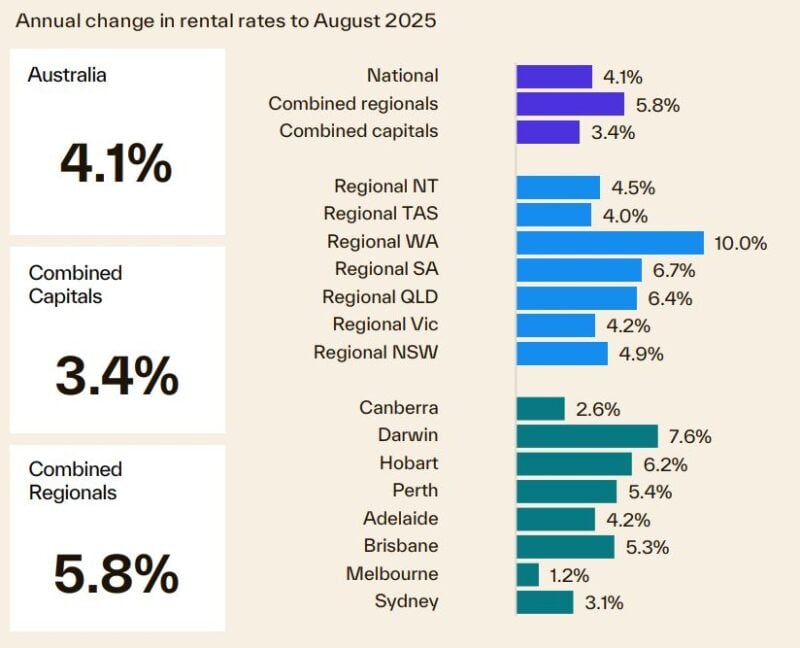

Both the combined resources and areas have seen energy integrate in rental trends. Because bottoming out in June, the 12 -month modification in resources city rental fees has actually raised 70 basis indicate 3 4 %, while the change in local leas changed from 5 3 % over the 24/ 25 Financial year, to 5 8 % throughout the years to August.

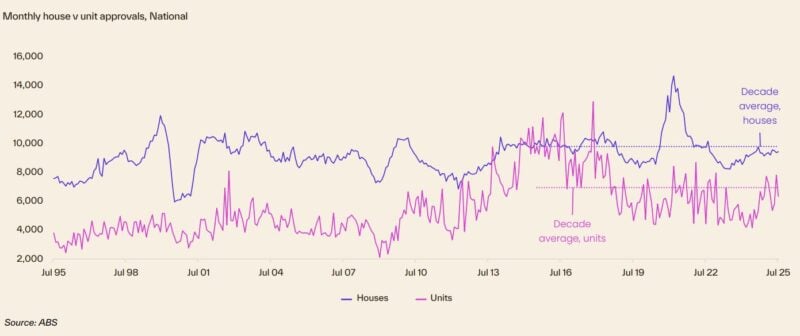

Monthly dwelling authorizations dropped – 8 2 % in July, adhering to the massive 12 2 % increase in June. The month-on-month decline was led by the device segment, with approvals down – 18 8 %, while home authorizations inched somewhat greater over the month, up 0. 6 %.

Need to know what’s happening to the real estate markets around Australia?

Well … this regular monthly collection of charts from Cotality (previously CoreLogic paints an intriguing picture.

The fast-tracked expansion of the federal government’s Home Guarantee System, efficient from October 1, is readied to substantially enhance the range of suburban areas readily available to first home customers, according to Cotality

The system, which permits qualified very first home customers to stay clear of lending institutions mortgage insurance coverage while acquiring a home with a 5 % down payment, will certainly currently eliminate earnings and area restrictions, while also elevating residential or commercial property rate caps across the majority of areas.

Under the old rate caps, around a 3rd of the 4, 848 house and system markets analysed across the country had an average worth below the corresponding restrictions.

Under the broadened limitations, this section leaps to 63 1 %, including 51 6 % of house markets and 93 7 % of system markets.

Cotality Economic expert Kaytlin Ezzy says the brand-new settings will encourage initial home customers with greater choice, while helping to level the having fun areas for those without accessibility to the bank of mum and papa.

She further claimed:

“Previously, to get approved for the plan, initial home purchasers were largely restricted to much more budget-friendly housing alternatives, including systems and houses in outer mortgage belts and local markets

Under the old caps, first home customers in Perth had access to simply two residential areas with a median house worth under the $ 600, 000 limit, Medina ($ 590, 786 and Mandurah ($ 589,965

Choices in Brisbane and Adelaide were likewise greatly restricted to units, with only 36 9 % and 41 3 % of suburban areas respectively falling under the old caps.”

She even more described:

“Because the caps were last changed in 2022, values across the mid-sized resources have actually grown substantially, which has actually seen first home buyers reliant on the system to buy a house, essentially priced out.”

The new rate caps stand for a significant boost for most areas and are designed to be more according to each area’s median home values.

For example, throughout Sydney and the Illawarra and Newcastle and Lake Macquarie regions, the cap has actually increased by $ 600, 000 to $ 1 5 million. In Southeast Queensland and Adelaide, the caps have both raised by $ 300, 000 to $ 1 million and $ 900, 000 respectively.”

Residential property underpins Australia’s riches

- The total value of Australian household realty was $ 11 7 trillion at the end of August 2025

- Impressive home loans versus all household real estate are just $ 2 4 trillion – a very comfy 21 % Lending to Value proportion.

- 55 9 % of total Aussie household riches is kept in residential property – one of the many reasons neither the financial institutions, the government nor the RBA wants a residential or commercial property accident.

Australian residence worths

- Momentum in nationwide housing worths has actually remained to construct with house values up 1 8 % over the 3 month to August, the largest quarterly increase since Q 2 2024 (20%)

- The yearly development trend also moved higher for the second consecutive month, ramping up from a reduced of 3 6 % over the 24/ 25 financial year to a 4 1 % increase over the 12 months to August.

- Growth in one of the most economical 25 % of consolidated funding city homes (2 1 %) was outmatched by the center 50 % of market (2 2 %) in the three months to August. This is considerable due to the fact that the bottom quartile has actually led market growth for virtually 2 years.

- Nonetheless, as a building investor you can constantly outperform the standard.

Our capital city markets are fragmented

Our housing markets are fragmented with each state performing differently depending on local economic and market variables.

At the beginning of this property cycle the top quartile of the market lead the increase in 2023, after that for fairly some time the reduced quartile across every funding city has recorded a stronger end result for housing values, currently the center 50 % of the market is performing highly.

The adhering to graph shows how different rate segments of each resources city market are doing in different ways.

Each State is running its own race

One star performer was Brisbane where building worths raised 7 9 % over the last year and are currently at a document high.

- Perth property worths are up 6 6 % for many years and are currently at a brand-new record high.

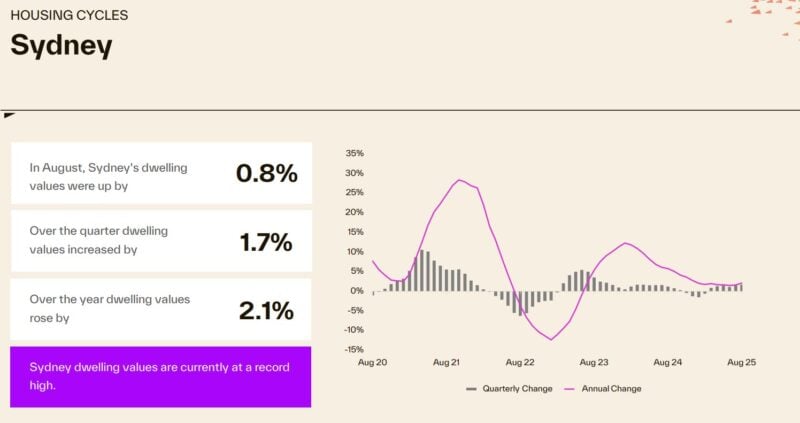

- Melbourne residential or commercial property worths are up 0. 3 % in August, additionally rose 1 4 % for many years, but are still – 3 % below its record high seen in March 2022

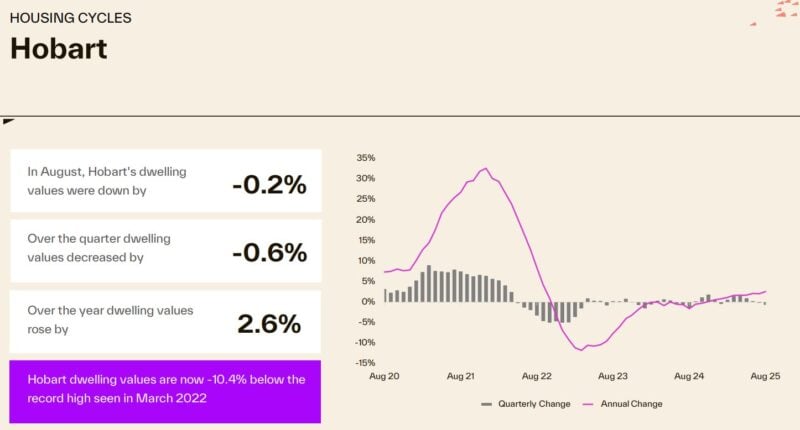

- In the previous beloved of the real estate markets, Hobart, house costs are – 10 4 % listed below their record highs videotaped in March 2022

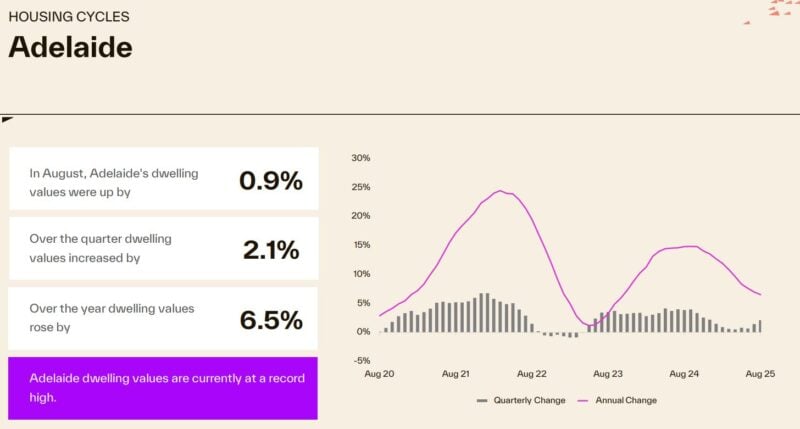

Here’s just how the Adelaide residential or commercial property market done.

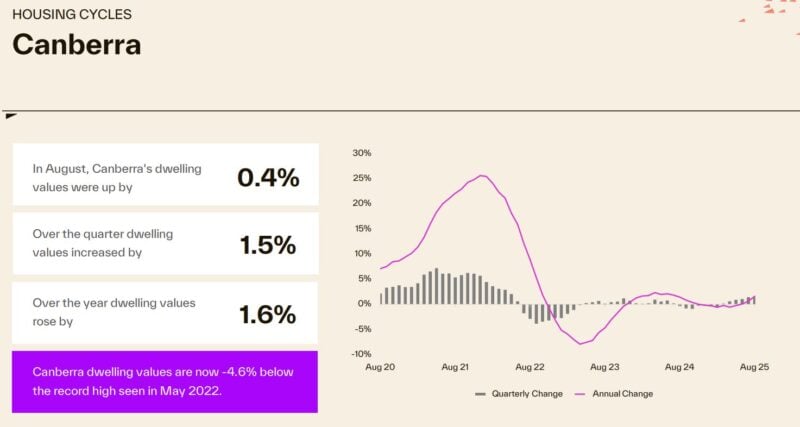

- Dwelling values in Canberra boosted 1 6 % over the in 2014.

- The Darwin housing market has actually carried out strongly raising 10 2 % in 2015 and is presently at a brand-new document high.

Here’s the number of residential or commercial properties are up for sale currently

- The circulation of new listings got momentum in the last month of winter season, with 34, 737 freshly promoted residential or commercial properties observed nationally over the four weeks to August 31 st.

- While down – 10 3 % from the degree seen this time around in 2014, and – 1 3 % reluctant of the previous five-year standard, listing activity rose 9 4 % in August, easily interest rates, rising view and more powerful resources gain problems setting the stage for a breaking spring marketing season.

- The issue is that very couple of are A Quality homes or financial investment grade homes Proprietors of quality residential or commercial properties are still holding onto them.

- In spite of newly advertised stock shifting higher, total stock levels have actually remained to decrease, with just 118, 380 building observed to buy nationally, over the four weeks to August 31 st.

- Because the begin of winter, complete listing degrees have actually decreased from – 14.0% listed below the five-year average, to – 20 2 % below average, with properties being soaked up from the marketplace faster from the marketplace after that they are included.

- Compared to this time in 2014, the 28 -day matter of listings is down – 13 3 %.

Purchase volumes

- Cotality estimates 43, 436 sales occurred country wide in August, taking the rolling 12 -month matter to 538, 329– 2.0% greater than this moment in 2015 and 3 8 % above the previous five-year average.

- Darwin stays the standout performer, with yearly sales estimates virtually 70 % over the standard, followed by regional WA (140%), Melbourne (13 5 %) and local Victoria (11 5 %).

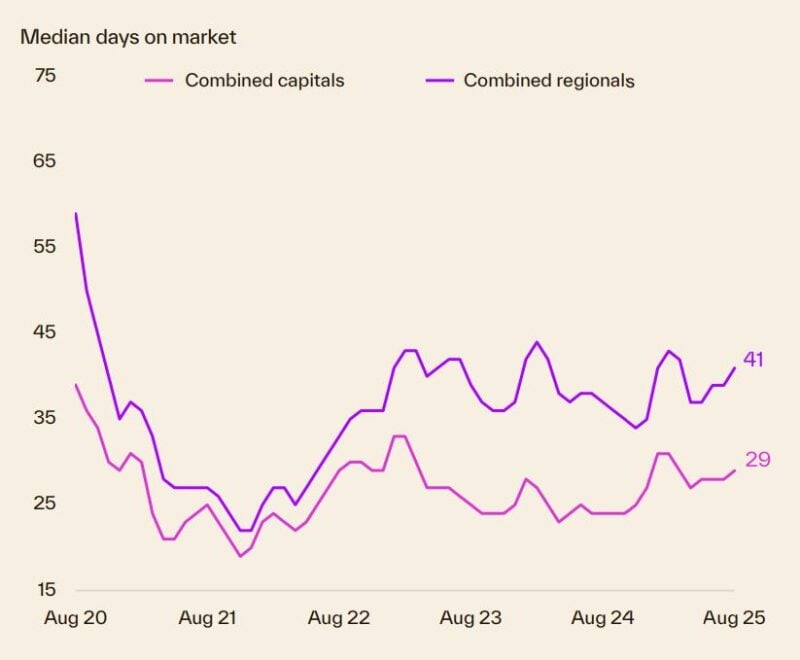

It’s taking longer to offer a home

- Despite seeing favourable worth development and sales task, homes are taking longer to market with the mean time on market climbing from 29 days over the three months to April, to 33 days in the August quarter.

- Perth continues to see the quickest selling times with a median time on market of 14 days.

- Meanwhile properties in Canberra (54 days) have seen the lengthiest marketing times across the capitals, after overtaking Darwin (44 days) back in April.

Vendor Discounting

- Considering that the beginning of the year supplier discounting prices have actually steadily lowered, with rate cuts and reduced supply levels moving discussing power back in favour of vendors.

- While approximately in accordance with the discount rates on offer this time around in 2015 (3 3 %), the national typical discounting price, at 3 3 % is below a current high of 3 7 % taped over the three months to January 2025

- Vendors in Hobart (4 4 %) continue to offer the largest discounts throughout the capitals, followed by Adelaide (3 6 %), while stronger selling conditions in Brisbane have actually seen the typical vendor price cut fall to 2 7 %.

Auction clearance rates

- The last month of winter saw capital city public auction activity increase, with regular task going beyond 2, 000 in the final two weeks of August.

- Success prices have actually additionally trended greater over the month, with the four-week rolling average clearance rate reaching its highest point in greater than 2 years at 69 5 %.

- The week finishing August 24 th was particularly strong, with 70 % of the 2, 066 homes auctioned across the consolidated fundings reporting a positive outcome.

- We update the regular auction clearance results right here each week.

We’re still experiencing a rental market dilemma in Australia

- The annual rate of growth in nationwide rental fees continued to tick higher for the 2nd consecutive month, with rental fees up 4 1 % throughout the years to August. Both the consolidated resources and areas have seen energy integrate in rental patterns.

- Since bad in June, the 12 month change in resources city rents has actually raised 70 basis indicate 3 4 %, while the modification in regional leas moved from 5 3 % over the 24/ 25 Fiscal year, to 5 8 % for many years to August.

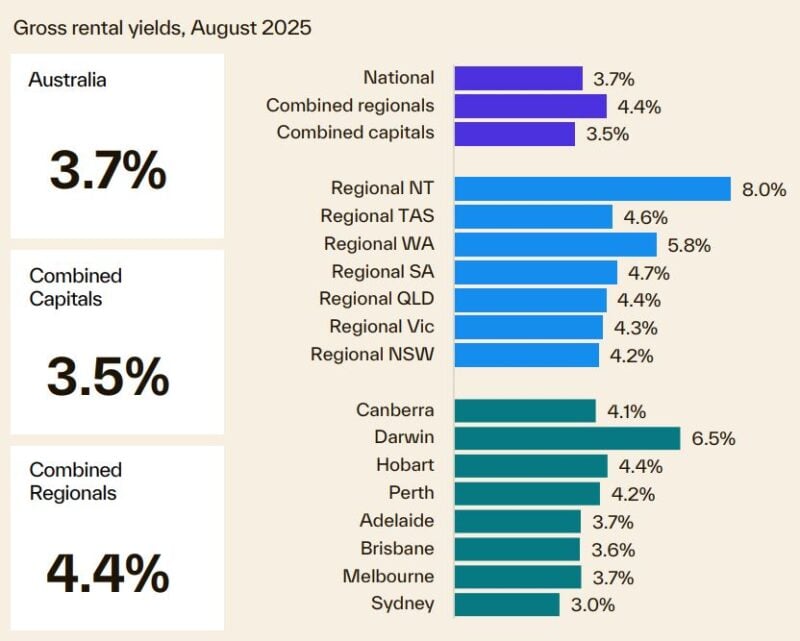

- National gross rental fee returns stayed level in August at 3 7 %, with returns throughout the combined resources and combined

regions likewise holding firm at 3 5 % and 4 4 %, specifically. - Contrasted to this time in 2014, rental home yields have actually climbed in Hobart (4 4 %), Canberra (4, 1 %), Sydney (30%) and Melbourne (3 7 %), while yields dropped across Darwin (6 5 %), Adelaide (3 7 %) Brisbane (3 6 %) and Perth (4 2 %) are down about this time in 2014.

Dwelling approvals and real estate credit rating

- Month-to-month residence authorizations dropped – 8 2 % in July, complying with the huge 12 2 % rise in June.

- The month-on-month decline was led by the unit segment, with approvals down – 18 8 %, while home authorizations inched somewhat higher over the month, up 0. 6 %.

- While authorizations have generally been tracking greater given that mid 2023, the average monthly authorizations for many years to day stay – 4 1 % listed below the years average and almost – 20 % down on the 20, 000 monthly required to satisfy the nationwide housing accord target.

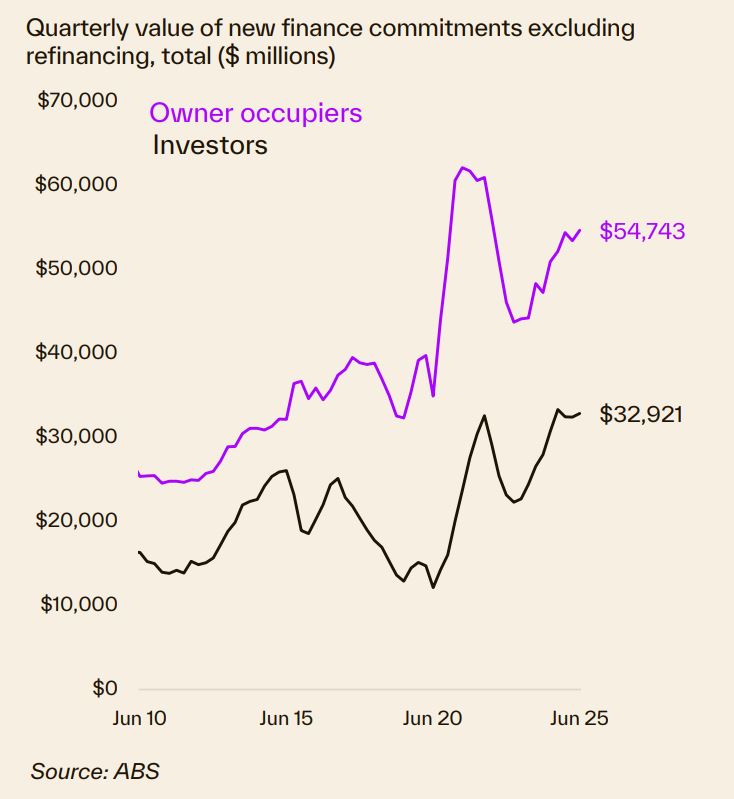

Money and Lending

- The quantity and value of new mortgage commitments rose in the June quarter, up 1 9 % and 2.0%, specifically.

- Investors drove the increase in quantity, with lending commitments increasing 3 5 % over the quarter compared to the 0. 9 % lift for proprietor occupiers.

- For car loan worth, however, owner inhabitants represented a lot of the rise, with the total value of dedications up 2 4 %, versus a 1 4 % rise in overall financier finance worth.

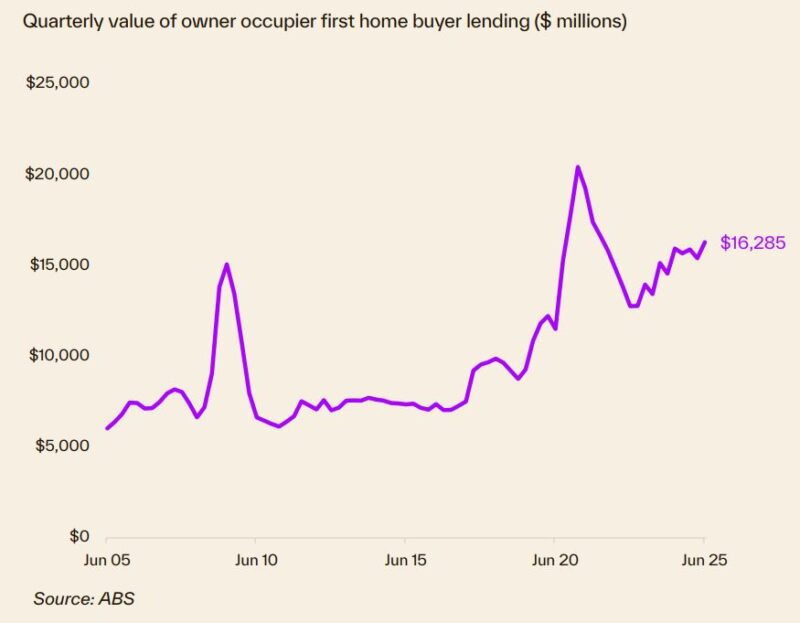

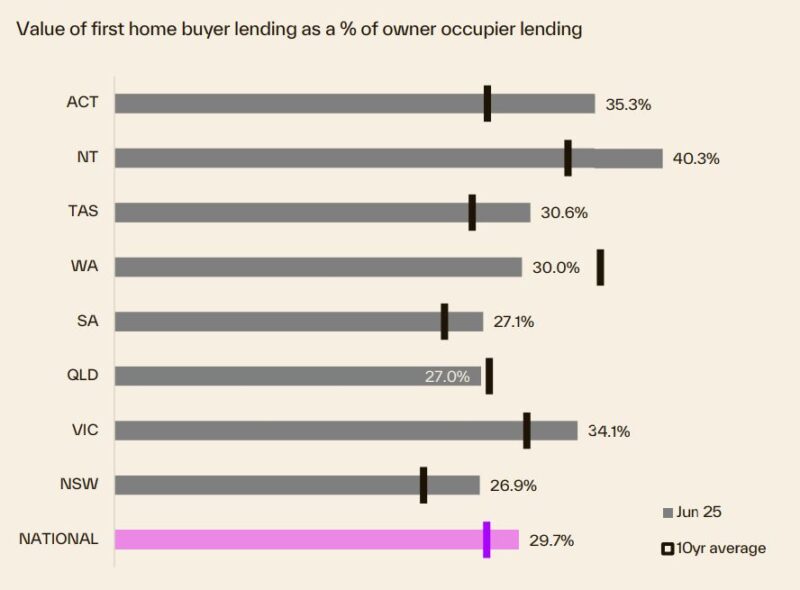

- First home buyer financing edged greater over the June quarter, aiding to take a break some of the declines seen through the March quarter.

- FHB financing quantities rose 1 7 % over the quarter, led by solid gains in TAS and the NT, up 15 4 % and 13 6 % specifically.

- At $ 16 3 billion, the overall value of FHB financing commitments (5 7 %) likewise climbed greater, with TAS (10 6 %) and ACT (8 3 %) publishing the biggest boosts throughout the states and territories.

Resource of graphes: Cotality Month-to-month Real Estate Chart Load, September 2025