Key takeaways

Capitals back on top: After a nine-month run of regional dominance, capital city home values have overtaken regional growth, rising 1.8% over the quarter compared to 1.7% in the regions – a shift driven by stronger sensitivity to interest rate cuts.

Regional rents still rising: Despite the swing in value growth, regional rents continue to outpace the capitals — up 5.6% annually versus 3.0% in metro areas. Albany (WA) led the charge, adding $82 per week to the median rent over the year.

Lismore’s comeback: Lismore (NSW) leads the top 50 regional markets with a 4.5% quarterly rise, marking a full recovery from its post-flood downturn and setting a new price peak.

Victoria’s sales surge: Regional Victoria is seeing renewed buyer momentum, reflecting a turnaround in sentiment.

Australia’s capital cities have reclaimed the growth lead from the regions for the first time in nine months, with data from the latest Cotality Regional Market Update showing metro values are rising at a faster pace than their regional counterparts.

Over the three months to July, the Cotality capital city Home Value Index rose 1.8%, while regional dwelling values increased by 1.7%.

While these results mark the end of regional dominance, they are not indicative of a downturn in the pace of regional growth.

Instead, the shift reflects the capital’s stronger sensitivity to changes in interest rates.

Throughout both the rate tightening and cutting cycles, capital city growth rates have been more responsive to interest rate changes, with the pace of growth showing a noticeable jump following both the February and May cuts.

Since bottoming out at -0.7% in January, the capital’s quarterly trend has continued to gain momentum.

The combined regions’ response to rate cuts has been more measured, with the quarterly trend holding relatively steady around 1.7% since April.

Beneath the steady headline number, results were more varied.

Across Australia’s largest 50 regional significant urban areas (SUAs), nearly 60% saw quarterly growth trends ease between April and July, while the other 40% gained momentum.

Regional standouts and slower markets shape growth landscape

Lismore (NSW) was the standout performer across the top 50 regional markets, rising 4.5% rise over the quarter to a new peak in July, making a full recovery from the nearly -18% decline recorded amid the 2022 flood recovery and concurrent interest rate hikes.

The rest of the top five was a mixed bag, with just one resource market, Bunbury in Western Australia, made the list, a significant departure from the trend seen over the past few years.

Western Australia and Queensland’s mining markets have dominated value growth rankings over much of the past two years.

However, momentum has eased as the relative affordability advantage that these regions once offered dissipates.

While no longer the top performers for quarterly growth, Albany (23.1%) and Geraldton (20.8%) in WA, and Mackay (18.2%) and Townsville (16.7%) in QLD, still saw the strongest annual increases.

Albany also recorded the shortest selling times (12 days) and some of the lowest vendor discounting rates (-1.7%).

At the other end of the scale, just three regions saw values decline over the year, with the Bowral – Mittagong region in the central highlands recording the sharpest decline (-2.1%).

The picturesque tree-change market saw significant growth throughout the early pandemic upswing, however, that growth saw the region become the most expensive market among the largest 50 regional SUAs and, behind Byron Bay and Sydney, the third most unaffordable market nationally.

This unaffordable price tag, coupled with normalised listing levels and below average sales, has put downward pressure on values.”

The Bowral – Mittagong region also recorded some of the weakest selling conditions, with properties sitting on the market for around 79 days and vendors offering a median discount of 5.3% in order to secure a sale.

Sales momentum builds across Victorian regions

Regional sales activity has steadily improved over the year to May, with annual sales rising in 36 of the top 50 SUAs.

Victoria claimed the top seven rungs on the scoreboard with sales counts in Shepparton – Mooroopna, Ballarat, and Bendigo jumping up 32.7%, 29.8%, and 26.4%.

Sales volumes across Melbourne and Regional Victoria have been somewhat muted in recent years due to less favourable taxation, demographic and supply changes.

Although rising from a low base, the uptick in annual sales activity reflects a turnaround in sentiment, with affordability advantages and capital gains prospects, reigniting buyer interest.

Lismore saw the opposite phenomenon, recording the steepest fall in annual sales activity, with counts declining from the previous year’s elevated levels.

While down almost 35% from last year’s post-flood recovery surge, Lismore’s transaction counts over the 12 months to May are down just -5.3% from the previous five-year average.

Regional rents still outpacing the capitals

While value growth has swung back towards the capitals, rent increases remain stronger in the regions.

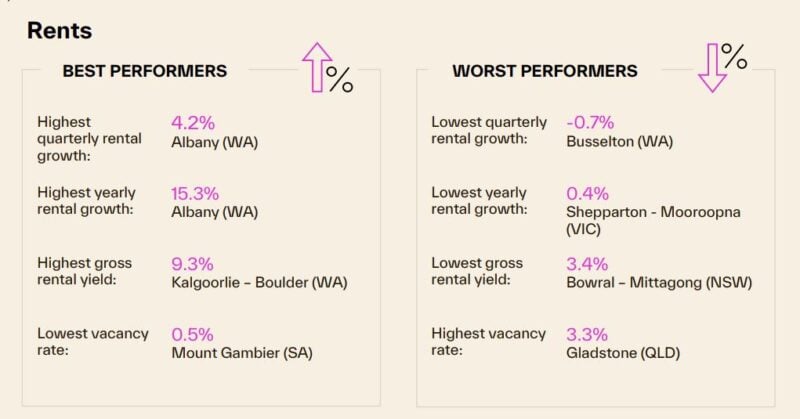

Regional rents rose 1.1% over the three months to July and 5.6% over the year, compared with 0.9% and 3.0% lifts in capital city rents.

Albany (WA) was again a standout, with rents up 4.2% in the quarter and 15.3% over the year, adding an additional $82 per week to the median rental value over the year.

Solid quarterly rises were also recorded in Goulburn (NSW), Victor Harbour–Goolwa (SA), Mount Gambier (SA), and Devonport (TAS) with rent increases ranging from 2.6% to 3.3%.

Despite a handful of markets posting mild quarterly declines, all 50 regional SUAs saw rents rise over the year.

Tight vacancy rates continue to underpin rental growth.

Despite worsening affordability, elevated regional migration and below-average rental supply are placing strong upwards pressure on rents.

As of July, just two markets, the Mildura – Buronga region on the NSW/QLD border, and the Nowra – Bomaderry market in NSW’s Shoalhaven region, have seen vacancy rates rise above their pre-covid decade average.

Key Insights – August 2025 Regional Market Update

- Regional dwelling values rose 7% over the quarter, falling behind the capital cities’ 1.8% rise.

- Across the country’s largest 50 regional markets, Lismore recorded the strongest quarterly growth with values rising 5%, while Forster – Tuncurry was the weakest, with values falling -1.5%.

- Albany, Geraldton, Mackay and Townsville remained the strongest annual performers, none although none of these markets featured in the top five for quarterly growth.

- Bowral – Mittagong recorded the steepest annual decline in values, down -2.1%, along with the weakest selling conditions.

- Victoria led the region for annual sales activity, with Shepparton – Mooroopna, Ballarat, Bendigo and the Mildura – Buronga region all posting annual transaction growth above 25%.

- Regional rents rose 1% over the quarter and 5.6% annually, continuing to outpace capital city rent growth of 0.9% and 3.0% respectively.

- Just three markets recorded a mild decline in rents over the quarter, Busselton ( – 0.7%), Launceston (-0.6%) and (-0.4%).

- All 50 markets saw rents rise over the year. Albany saw the strongest annual rental growth, up 3% or $82 per week, while the Shepparton – Mooroopna region saw the weakest (0.4%).

- Kalgoorlie-Boulder continued to record the highest gross rental yields at (9.3%), while yields across Bowral – Mittagong remined the lowest (3.4%).